Don't miss the chance to work with top 1% of developers.

Sign Up Now and Get FREE CTO-level Consultation.

Confused about your business model?

Request a FREE Business Plan.

Why To Develop Chatbots For Banking And How Much Will It Cost?

Table of contents

The advancements in the latest technology like chatbots for banking and other trends have forced the market to evolve and modernize its methods. Banking is one of the most developed and advanced sectors of the economy. This means that this sector is the hotspot to integrate advanced technological functionalities like a chatbot for banking more than anything else.

The key to a growing business is communication with the customers. Industries are now moving towards the account-based approach of communication rather than person-to-person. The sectors that work closely with the customers, believe communication to be the most powerful tool.

In today’s times where artificial intelligence, machine learning and other technologies are overpowering every business sector, introducing a chatbot for banking would be a great business idea. This chatbot will serve as a conversational banking medium.

This chatbot for banking aka conversational banking will enable the banks to deliver their services to their customers without spending extra manpower, time and resources. In 2017, a survey conducted by Celent demonstrated that 85% of the banks believe that artificial intelligence will increase their banking and 32% of the banks have already invested in this technology.

In this blog, you will learn how you can develop a chatbot for banking, what features must be included, how it will benefit you and the customers and how much it will cost!

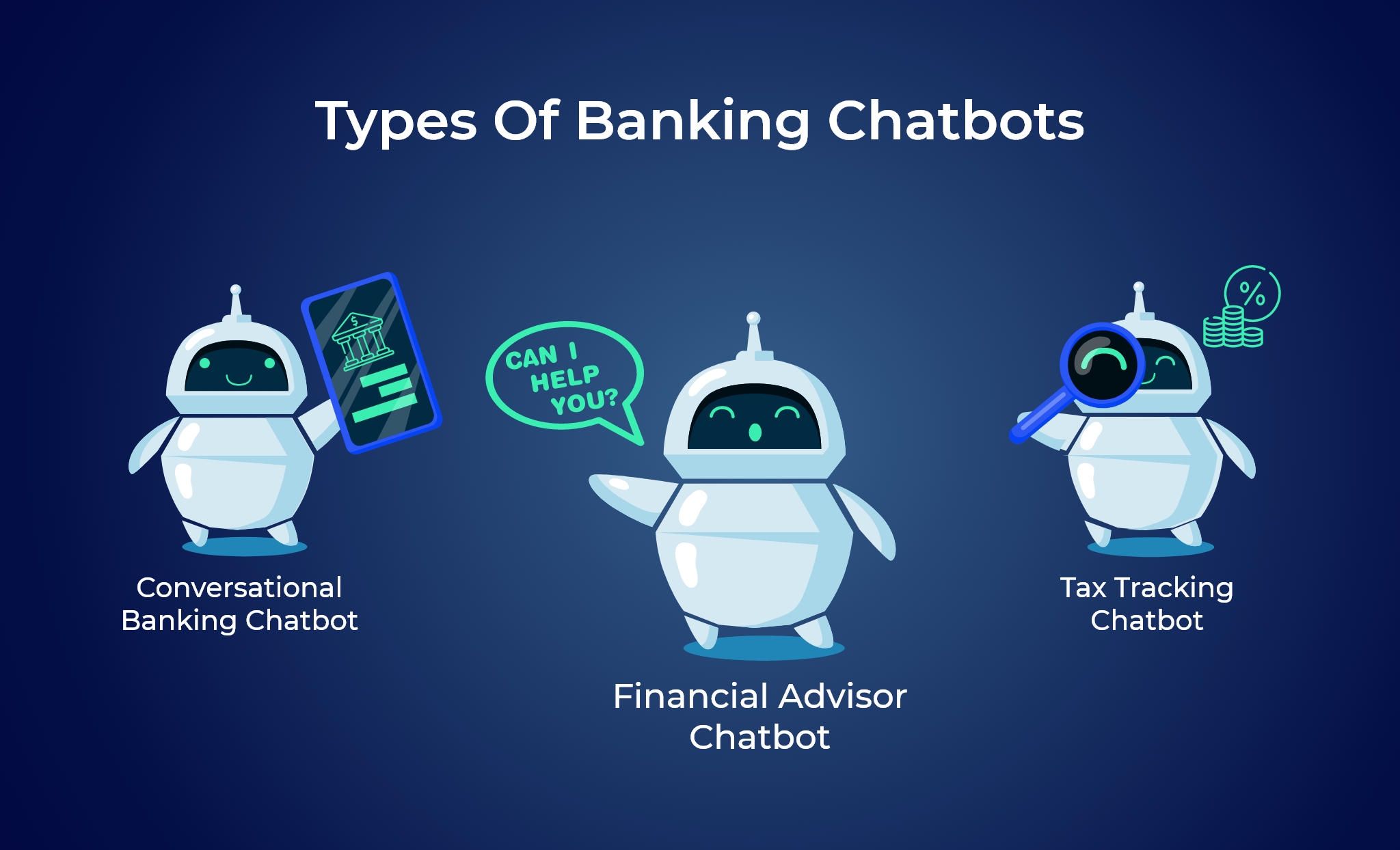

Types Of Chatbots For Banking

Chatbots can be used not only for simple communication with the users but also for advisory functions. Based on the general roles and responsibilities in the banking sector, there are three main types of banking chatbots discussed below:

Conversational Banking Chatbot

Having a chatbot for banking, mainly a conversational chatbot has really been eliminating the need for human agents in that field. Conversational chatbots are built on technologies that understand languages. These maintain easy communication with various customers at the same time without confusing a single customer.

Chatbots for banking sectors are developed in a way that they understand everything about customer requirements including application for new cards, managing services or funds, etc. These conversational bots can converse effectively regarding any financial work.

Financial Advisor Chatbot

Having a chatbot for banking that serves as a financial advisor is a great add-on to the banking industry similar to any consultation app to guide us. A financial advisor chatbot is made for advising the customers before their investment in anything based on the provided data. These chatbots also give suggestions and personalized tips for planning budgets.

Chatbots for banking play a crucial role in making financial decisions as these bots will offer their suggestions on how to make better investments and save money. These chatbots are user-friendly and they understand what the user is trying to communicate.

Tax Tracking Chatbot

Tax tracking chatbots for banking offer their services by suggesting the users how to monitor their expenses and save taxes. Built with natural language processing and machine learning subjects, these chatbots are efficient in their work. They help customers by tracking their expenses and deducting the taxes on time so there are no late charges. Users can keep track of their savings and expenses simultaneously with the help of tax tracking chatbots for banking.

Top 3 Use Cases Of Future Chatbots For Banking

The trends of technology are evolving every day and so are the demands of companies and clients. The urgent requirements or any minor query raised by the customers can be solved by the chatbots without disturbing the agents. Following are some use cases that people may encounter while conversing with chatbots for banking:

Opening Bank Accounts

The simple request “I want to open a bank account” is the beginning of a very time-consuming and complicated process. The easiest method followed these days to open a bank account is reaching the banking and dealing with the process person-to-person.

There are some banks that have started allowing the users to open bank accounts remotely but eventually, it also requires the customer to complete separate steps and procedures, always with the assistance of an employee.

Regulators also order the involvement of a human assistant, but this is another area that will certainly change in the future. This mechanism can be completely automated using digital account opening, such as by a chatbot or other conversational platforms. Here are glimpses of chat templates that will escalate the bank account openings with very fewer efforts.

“To proceed with the opening of your bank account, we need you to send us a proof of residence”

The documentation that the customer submits like address proof, etc. is processed by an automatic system. This system verifies if the information in the document is reliable or not.

“We are almost done! We need to make a brief video call with you to check your data. Can we proceed?”

If any communication medium needs to be initiated with the customer, the chatbot for banking will do it. In this method, the customer wouldn’t have to change the channel as the calls will occur with the chatbot. The ability to communicate with the chatbot decreases the rate of abandonment in the middle of the operation greatly.

“Validation and signature is next for opening your bank account”

In this final step, the customer signs the document digitally and ends the process. There are many ways of validation that can be supported like digital signatures and biometrics. In digital signatures, the signature done is matched with the signature on the identification paper. On the other hand, in biometrics, there are no additional actions required to cross-check customer’s data.

Finance & Transaction Management

One of the most important use cases in finance and transaction management. The process of crediting or debiting money from a bank account and sending it to another account is very time consuming and cumbersome.

“I would like to transfer $50 to Mr X and cancel the debit on 25th January”

Customers can do financial operations and management through chatbots for banking. Speech-to-Text (STT) and other automatic speech recognition systems aid in the delivery of voice requests. It also includes client information stored in their profile, such as addresses or often performed operations (such as transfers).

With this technology, banks are able to interact and be involved with their customer on daily basis. Hence, they are proving to be helpful in personal finance management.

Credit Request

Credit requests are one of the processes that consume a lot of time by having a lot of paperwork including signatures, document deliveries, etc. Although, all this has to be kept in the past. As of now, without leaving your house, you’ll be able to simulate and specify the credit you want, send the necessary paperwork, and sign the contract. Imagine the process of buying a house.

“I want to buy a house and I would like to know if the bank can lend me the money”

After this request, the chatbots for banking may send your the link for the home loan agency and you can start with the process. You can input the information relevant to the loan like the location of the house, size of the property, value requested, etc.

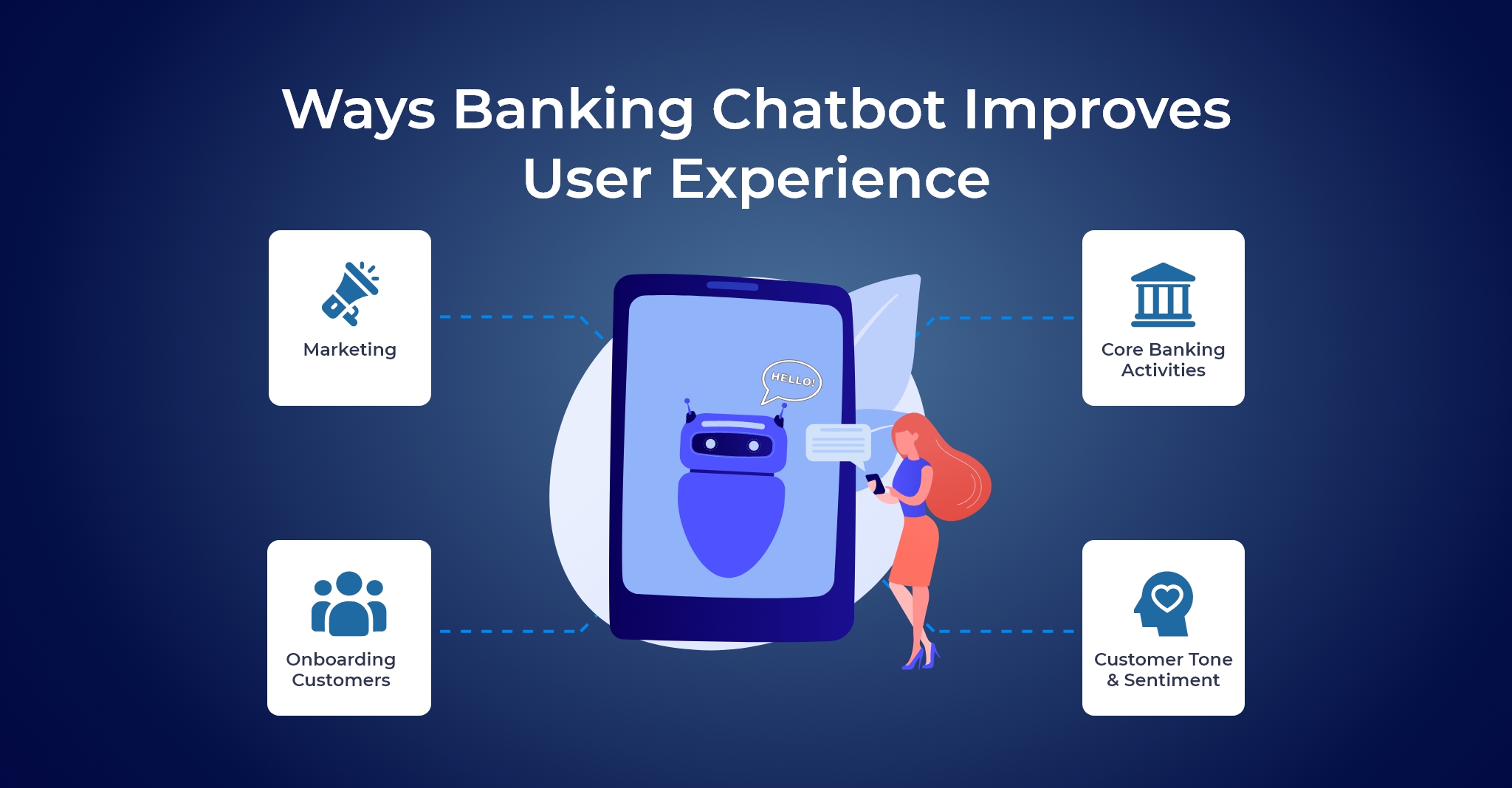

How Chatbots For Banking Improve User Experience?

Customer expectations in the banking sector have increased gradually over the decade. Earlier people wanted to just come into the bank and wanted to get all their work done as soon as possible. Nowadays, people want everything done online. People are not ready to commute to the banks for a single job. By introducing chatbots for banking, a communication medium can be set up for a better user experience. Some of the ways that answer to how chatbots for banking improve the user experience are discussed below:

Marketing

Chatbots for banking can be used as an asset to increase the brand loyalty of the bank and to improve customer experience as well. These chatbots have the potential to customize the user experience, enable push notifications for every user, collect and perform analysis of the feedback received, helping in sales, and many more.

Onboarding Customers

Chatbots for banking play an important role in this sector as they can easily communicate with the customers while they can be performing any task. They can be visiting the landing pages, filling up any application, etc. Chatbots can bring traffic to the landing pages and other pages of the platform.

Core Banking Activities

Chatbots are also capable of handling the core banking activities like payments, loan, etc. within the chat window. Customers can perform various actions like transfer of money between accounts, paying invoices, applying for a mortgage, and many others while communicating with the chatbot for banking.

Customer Tone & Sentiment

Chatbots for banking has been refining their algorithms better to understand the sentiment of users clearly including double negative sentences. There are some chatbots that are developed in such a way that they can understand sarcasm as well. Understanding the tone and sentiment of the customers will allow the bank to serve the customers according to their need. The chatbots for banking can also get connected with a human customer service agent so that urgent cases can be given attention immediately.

How Will It Be Beneficial To Make Chatbots For Banking?

There can be various benefits of the development of chatbots for banking. The major ones that prove to be very beneficial are discussed below:

- Improved Customer Experience: Ther chatbots should be fast, efficient and polite while conversing with the customers. The chatbots for banking should be supportive and achievable towards the goals.

- Customizing Customer Experience: According to Retail Customer Experience, 63% of customers expect customized services. Banking chatbots can provide them with the services by analysing the information given by them.

- Reduce Waiting Time: The chatbots for banking would help in reducing the lines at the banks and the waiting time on phone calls. These issues can finally be solved by a virtual assistant.

- Cost Reduction: According to Juniper’s Research, chatbots for banking and healthcare industries are likely to reduce the cost of delivering services by around $8 billion per year by 2022.

- Doing The Job Better: A study in Salesforce suggested that 64% of agents are supported by chatbots. This helps the agents in solving complex problems instead of being busy answering minor queries.

- Data Collection: Chatbots for banking are able to collect information about the customers so that they can be delivered required services efficiently.

Points To Consider To Boost Your Banking Chatbot

There are a lot of things that can help in boosting your chatbot for banking. Some of them are discussed below:

Custom Branding & Design

The bot window can be designed for any business according to the requirements of their brand. The bots shall be built with easy and efficient features that will gather a lot of attention and attract customers.

Technical Support

The chatbot for banking is built with advanced technologies like artificial intelligence and natural language processing. These help the bot to understand various conversations and learn new queries from the customers and deliver the best answers.

Bot Analytics

The banking chatbot will include a lot of analytical functionalities like conversion tracking and reporting, chat intelligence, and others. This will also help in optimizing the tasks and gathering insights on customer behaviour.

Integrating CRM

The chatbot for banking will support various collaborating channels and also supports the integration of CRM with the bot to work on some lead/enquiries updates.

Chatbot Templates

There are several templates for chatbots that are ready to be used at any time. These templates are of finance, assistance, banking, etc. and they help to provide a better customer experience.

Fraud Detection

The chatbots also help the bank monitor to check if there are any fraud or suspicious activities. If found any, the customers and admins will be informed immediately.

How Much Cost Can Be Estimated To Make Banking Chatbots?

A chatbot for banking can take care of all the queries uploaded by customers related to banking services. The most essential part is to choose the right mobile application development company that provides excellent chatbots for banking solutions. These chatbots are usually developed with the technological advancements of artificial intelligence, machine learning, natural language processing and others.

The cost of the development of chatbots for banking can depend on various factors and requirements like features, platform integration, technologies used, etc. The right mobile application development company can give you the estimated cost for the banking chatbot based on your requirements. The approximate cost of development can range from 6000 USD to 20,000 USD.

Conclusion

Provided the success of initial AI ventures, chatbots for banking will advance in banking and financial services. Predictive analytics can aid in deciphering the massive amounts of data that banks collect. When tireless computers analyse data intelligently, trading and investing can have greater predictability.

Perhaps, most notably, banking chatbots can become more intelligent. Chatbots for banking can improve with major advancements in AI and Machine Learning. While we can’t say when chatbots will become super-intelligent, we can surely say that an excellent human-chatbot relationship is a way to go in the near future.

Rate this article!

(3 ratings, average: 5.00 out of 5)

Join 60,000+ Subscribers

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Lively and spirited. You may call me a tech-geek. I like to explore latest advancements in the technical areas and develop case studies. Being a computer science graduate, I like to traverse through the technical platforms as well. You can find me understanding or playing with the latest technology.

Telemedicine 2.0 - A Comprehensive Guide On What Healthcare Providers Need To Know?

Discover how the latest advancements like Artificial Intelligence in telemedicine are reshaping patient care. This comprehensive resource offers insights into the key trends and innovations driving this shift, providing valuable knowledge for healthcare professionals looking to stay ahead.

Download Now!Worried about

development cost?

Pay in EASY and FLEXIBLE INSTALLMENTS.