How Much Does Mobile App Development Cost in Abu Dhabi? Factors, Pricing & Timelines

9 Views 14 min December 5, 2025

Introducing Nalini, our tech-savvy content expert at Apptunix, with 8+ years of experience in technical content writing. With a knack for making complex ideas simple, she turns intricate tech concepts into engaging reads. Her work highlights emerging trends such as AI-powered applications, cross-platform development, digital transformation initiatives, and B2B technology solutions. Through her strategic storytelling, she plays a vital role in advancing Apptunix’s mission to shape the future of mobile and web experiences, enabling clients to make smarter, technology-driven decisions that accelerate growth and secure a competitive edge.

Planning to launch your mobile app & scale your business exponentially – get in touch at nalini@apptunix.com to discuss your idea or project.

These days, customers constantly seek convenient and fractional payment options that align with their financial goals and purchasing behavior. This swift transition in the FinTech companies has paved the way for numerous innovative solutions, among which the Buy Now, Pay Later (BNPL) solutions are rapidly catching up – and is here to stay.

In addition, BNPL apps not just improve the customer experience but open up new avenues for financial planning and management.

The tremendous surge of Buy Now, Pay Later in the U.S. is underscored by the staggering growth, which is expected to grow by 1200% by 2025. Buy Now Pay Later (BNPL) Market Size Worth USD 83.36 Bn by 2034 powered by E-commerce and digital payment growth. These awe-inspiring expansions shed light on the growing consumer demand for flexible payment solutions. If you’re planning to step into FinTech app development by creating a BNPL app development – we’ve got you covered!

In today’s guide, we’ll cover everything from BNPL app development process, overall development cost, features & functionalities, and many other factors.

Some big names like Klarna (Sweden), Affirm (United States), Afterpay (Australia), and Tabby (United Arab Emirates) cater to this growing demand by providing the option to pay for goods and services over time, making shopping more accessible and financially manageable. Let’s take a look at compelling reasons why it is the perfect time to invest in BNPL app development and why you should consider building your own BNPL application:

The BNPL market is expanding at an unprecedented rate, making it an ideal time to invest in app development. Globally, the market is projected to reach $560.1 billion by 2025, with users growing from 360 million in 2022 to 900 million by 2027. The BNPL segment is fueled by increased smartphone penetration and digital payment adoption. This rapid growth highlights the immense potential for businesses looking to capitalize on the rising popularity of flexible payment solutions.

BNPL apps offer significant benefits for merchants by boosting revenue and encouraging purchases. Studies indicate that integrating BNPL can increase average order values by 20–40% and reduce cart abandonment rates. Customers are more likely to complete transactions when given the option to pay in installments, which translates into higher sales, improved customer loyalty, and a competitive advantage for platforms offering these services.

Consumers, particularly Millennials and Gen Z, increasingly prefer BNPL for its convenience and cash flow management benefits. The service is gaining traction not just in urban centers but also in tier-2 and tier-3 cities, especially where credit card usage is limited. By offering BNPL, apps meet the growing demand for flexible, accessible payment methods, thereby driving greater user adoption, engagement, and long-term retention.

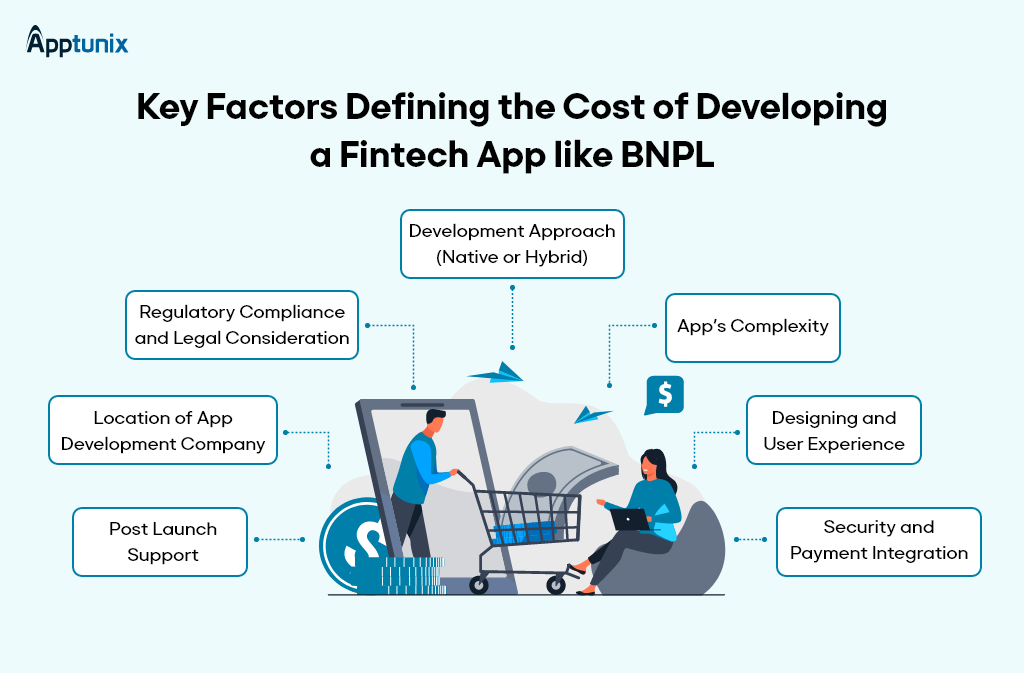

If you are in the same room as millions, who are vouching for it, let’s plunge straightway into vital factors that go into building a fintech app like Buy Now, Pay Later.

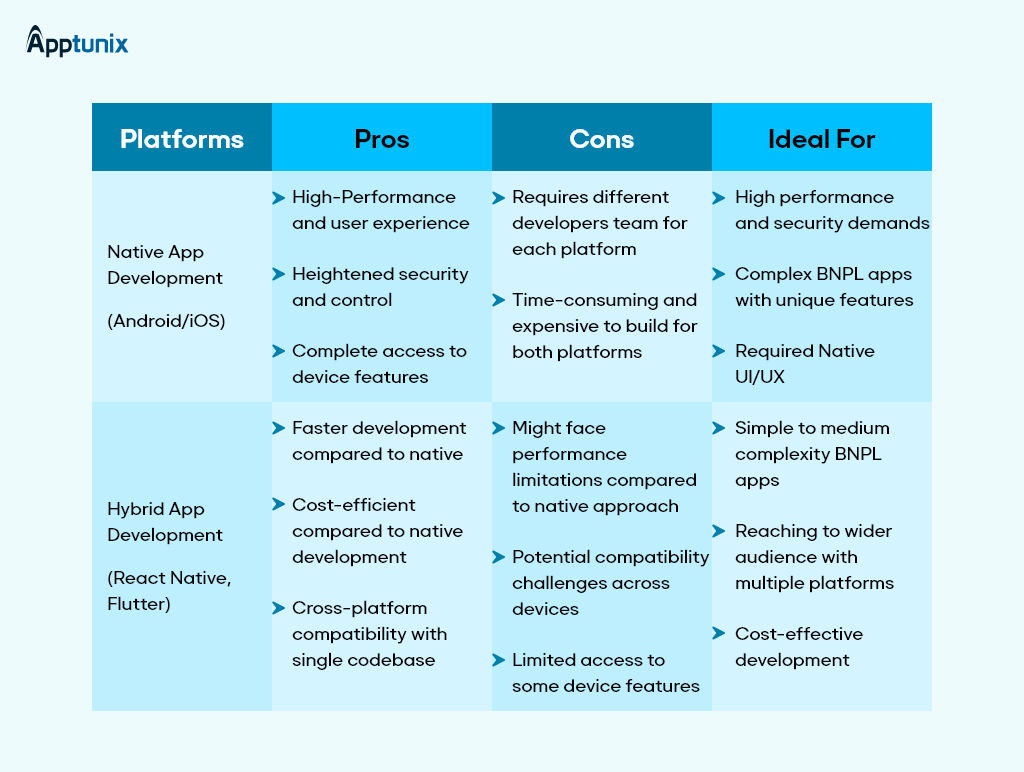

Selection of the platform for a BNPL app is inevitable as it significantly impacts the entire project development cost. Whether you are choosing Android or iOS BNPL app development or want to target both simultaneously, choosing the native or hybrid development approach lays the foundation.

Furthermore, the platform you make up your mind to go for comes with its own set of native development challenges and costs. For example, iOS and Android require different fintech app Android & iOS developers, and skillset, adding to the cost of BNPL app development.

However, a hybrid approach acts as a more universal solution but might lag in offering the same user experience as native apps. Weighing the platforms and keeping the target audience in mind is important for aligning costs with the fintech app’s success.

While planning a Buy Now, Pay Later app, the complexity and customization level are crucial considerations, in determining the complete development cost. Though, basic apps with simple features prove cost-efficient but may not stand out in the bottleneck competition.

But, as you add custom features and integrations, the development time and resources increase. This surge has direct implications for the budget, making it important to balance feasibility with innovation.

Notably, a personalized app has the potential to exceptionally improve user experience, driving higher adoption rates and bracing the investment.

There’s no doubt, a flawless user experience and seamless design are inevitables for the success of any BNPL app. These aspects require diligent planning and skilled execution, directly influencing the fintech app development solution like buy now pay later development cost.

Thus, investing in best-in-class UI/UX design assures the app is user-friendly, easy to navigate, and eye pleasing, eventually improving customer retention and satisfaction. Often, the design process includes target audience research, wireframing, prototyping, and A/B testing, each adding to the development cost.

Yet, this aspect is important for developing an app that outshines in the flooded sea, while catering the high expectations of today’s customers.

For a fintech App Development Company – Security Integration is Not a Choice, It’s a Necessity

Payment system integration is an important step in developing a BNPL app, as it ensures transactions are processed seamlessly and securely. Besides, developing a BNPL requires meticulous planning and execution to safeguard customer financial information and compliance with financial regulations.

Additional security measures, like fraud detection algorithms and encryption, turn into a necessity to protect user information. This technology integration is not about adding to the development cost but also needs expertise in financial technology.

Successful integration of safe and secure payment is key to gaining user’s trust while ensuring the app’s long-term viability.

Complying with regulatory compliance and legal frameworks is another important aspect when developing a Buy Now, Pay Later app. Thus, ensuring compliance with Know Your Customer (KYC), Payment Card Industry Data Security Standards (PCI DSS) and Anti-Money Laundering (AML) requires a thorough knowledge of financial laws and regulations in several regions.

Adhering to this compliance is crucial to protect customers’ rights and promote financial integrity, shaping the app’s functions and structure. In essence, legal compliance varies widely, impacting the development scope, budget and timeline.

When leveraging fintech app development services, integrating these considerations is crucial to prevent expensive adjustments in the later development stage and compliance with all legal standards for operation.

Paying careful attention to legal details curates the fintech app’s credibility and longevity in the competitive landscape.

Recommended Read : Comprehensive Guide to Fintech App Development – Features and Benefits

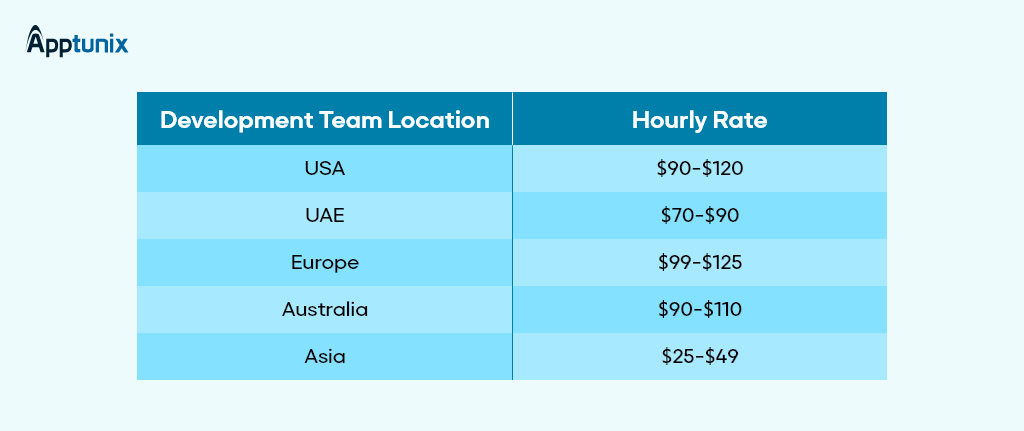

The location of your fintech app development services provider is an important factor influencing the cost of BNPL app development. Partnering with the right fintech app developers not only saves a lot of money on development costs but also helps you with monetization strategies for BNPL apps that are the buzzword in the market, like Klarna.

But the ground reality is entirely different, outsourcing your development requirements will help you segregate the pre-requisite among experts of their respective domains, leading to faster turnaround time and minimal cost-per-hour. Furthermore, because of the lower operating costs and hourly development rates, companies based in Asia prove to be an economical and valuable decision. Whereas, choosing a fintech app development company in the US or UK could lead to an expensive hourly development rate.

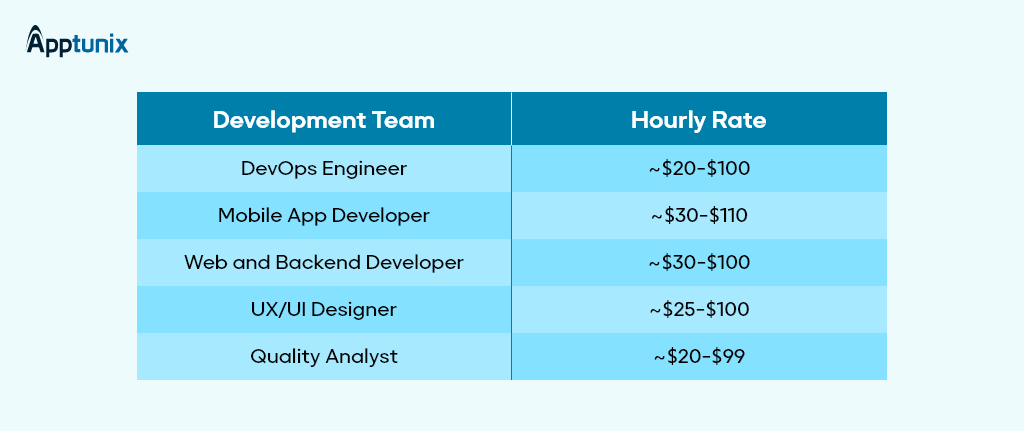

Besides, hiring the right FinTech app development team with the right skillset, saves a lot of money on app development considerations. Whether that is Quality Analysis, UI/UX design, or functionalities integration, it saves a lot of money with a talented pool.

Here’s an estimated cost estimation based on team roles.

After rolling out your app, constant maintenance and support are crucial for its success. These services make sure the app is up-to-date, functional and safe in adherence to the latest technology trends.

A trusted fintech app development provider offers constant monitoring and improvement to keep track of updates, error resolution and security concerns. Though, these services add to the complete cost but are crucial for an unparalleled and uninterrupted user experience.

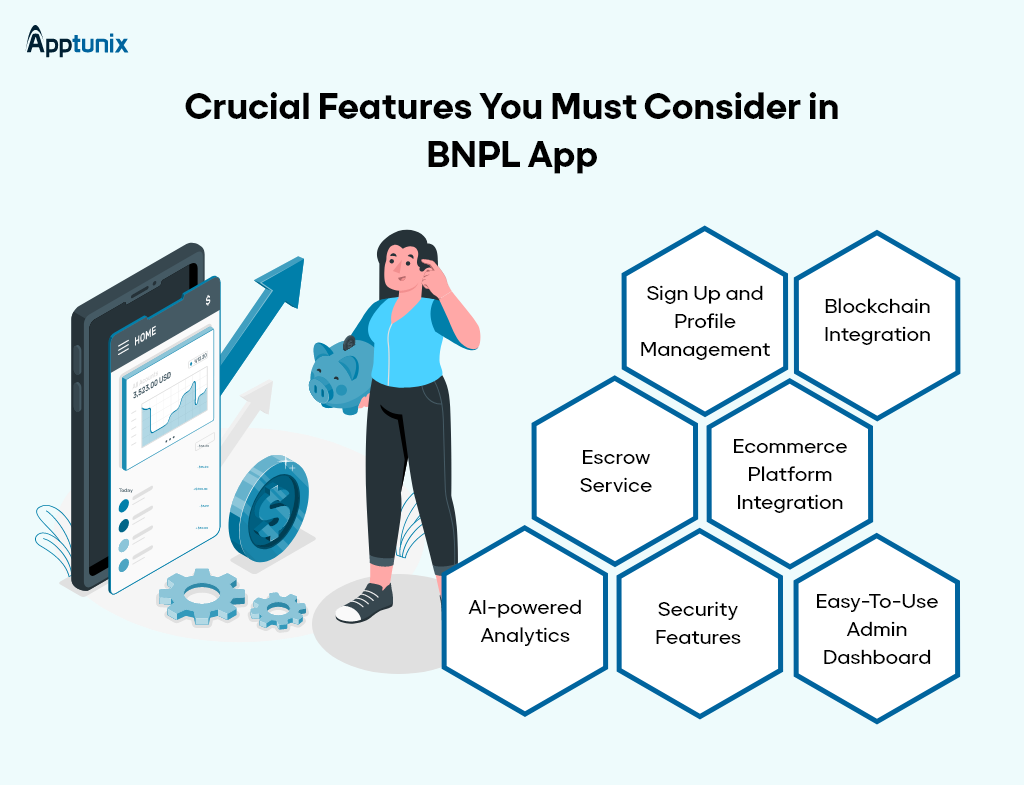

Below are the features you must consider when building a fintech app like Buy Now Pay Later (BNPL).

When building a Buy Now, Pay Later app, having an intuitive yet easy-to-use sign-up process and profile management system is important.

Must be wondering why. Because a seamless profile management system caters as a foundation for tailored shopping experiences and secure payment transactions. Also, it enables users to update their information, manage payment methods and keep track of their purchases and payments.

In essence, it’s a vital part of BNPL app development like AfterPay, ensuring the app is user-friendly. Besides, it’s equally crucial to integrate security features with a focus on security and user experience that significantly uplifts the complete user experience, nurturing engagement and loyalty for the app.

Leveraging Blockchain technology offers endless benefits, especially for Decentralized Finance (DeFi) operations.

One inescapable benefit is improved transparency rooted in the inherently open nature of distributed ledgers. Each node in the network has identical copies of the ledger, eliminating the minimal possibility of any single entity altering records unnoticed.

Another unskippable advantage is immutability. This means, that once data is recorded, remains unchanged, unaltered and memorable. This aspect eliminates opportunities for any potential breaches within centralized financial systems that are prone to human error or malicious attacks.

Therefore, including distributed ledger technology in fintech app development solutions provides considerable benefit in terms of transparency and security unmatched by conventional banking infrastructure.

Notably, these attributes endorse investors’ trust while minimizing vulnerabilities related to conventional financial models.

Escrow is a term describing a financial agreement whereby an asset or money is held by a third-party on behalf of two-parties that are completing a transaction.

In today’s tech-savvy world, escrow accounts are crucial safety measures within BNPL services to safeguard both parties, especially in peer-to-peer lending transactions. When it’s about escrow services, it’s recommended to include trustees managing the escrow accounts and fund holdings until transactions get completed.

Integrating this service, makes users assure their money will not lead to losses resulting from any fraudulent activity or breach of personal information shared during the transaction process. Moreover, trustees track account fund disbursements only when all the boxes are checked, offering peace of mind to everyone involved in direct lending activities through the platform.

For a startup looking to thrive by leaps and bounds, including escrow service in the BNPL app is a must as it helps ensure transparency and fair dealings among community members engaging on the platform.

Integration of Buy Now, and Pay Later with e-commerce platforms are essential for offering a seamless shopping experience. These integrations enable users to access BNPL payment options directly within online stores, empowering quick purchases without abandoning the cart. Plus, it streamlines the checkout process, enhancing customer satisfaction and conversion rates for merchants.

Therefore, establishing these integrations requires technical expertise and strategic partnerships with e-commerce platforms, focusing on the importance of collaboration in the digital payment ecosystem.

Integration with e-commerce platforms not only widens the app’s usability but also presents it as a valuable tool for customers and businesses alike.

There’s no doubt that AI-driven analytics helps in BNPL app development for optimizing business operations and enhancing decision-making. This tech stack allows the collection and analysis of data, providing insights into customer behavior, market trends, and app performance.

Leveraging these insights, businesses can personalize their offerings, predict market changes, and uphold user experience. Also, AI helps in identifying potential threats, reducing risks, and enhancing security. Though, the integration of advanced features in a fintech app development solution requires a huge investment, it equally nurtures substantial returns through efficiency, customer satisfaction and profitability.

Incorporating advanced security features, like encryption and biometric access is important for a Buy Now, Pay Later app. These security measures safeguard user data and transactions, building credibility and ensuring a safe payment environment.

Including biometric access adds an extra layer of personal security, while encryption protects data during transmission. Although, adding these additional security features needs expertise that comes with an added development cost but are essential for complying with financial regulations and eliminating fraud.

Thus, investing in these security features is crucial for keeping the integrity of the app and fostering a protected climate for merchants and users alike.

An easy-to-use admin dashboard for the merchant side is an essential feature of the BNPL app. This dashboard will allow merchants to manage their sales, track payments, and view customer analytics easily. Also, it gives easy access to the tools required for effective decision-making and financial management.

The dashboard acts as a pivotal point for merchants to handhold real-time data, improving their ability to address evolving market trends and customer requirements instantly. In a nutshell, integrating a user-friendly admin dashboard nurtures strong relationships between the platform and its merchant users, contributing to the success and efficiency of the BNPL app.

You can choose a fintech app development company to integrate these features into your BNPL app. Now, let’s discover how BNPL apps actually make money.

There’s no doubt, that the integration of BNPL proves to be a valuable addition to your business payment choices, driving sales, providing various profit avenues and enhancing customer loyalty.

Let’s comprehend the various sources of income of the BNPL app that can contribute to your profitability.

In your BNPL app, considering up-selling or cross-selling other financial products like credit cards or personal loans is a lucrative strategy. These financial products generate passive sources of income from interest fees for your app.

BNPL service provider charges merchants a specific fee for every transaction, typically in the bracket of 2-8% of the sales cost. Thankfully, businesses are willing to pay this fee as it manifolds their sales and average order values.

This stands true to the old cliche – “Tradition holds value”. For a fintech app development solution like BNPL can collaborate with other businesses for marketing and advertising campaigns. These collaborations generate income through co-marketing efforts and activities

In cases where customers choose extended repayment plans or miss payment schedules, you can charge interest on the remaining balance. The interest revenue proves to be a significant source of income ranging between 10% to 30% depending on customer credit or tenure of repayment.

The voluminous data collected on customer behaviour and purchasing habits is a valuable asset for businesses worldwide. BNPL providers can leverage this data for targeted advertising, market research, or selling insights to other businesses, producing additional revenue.

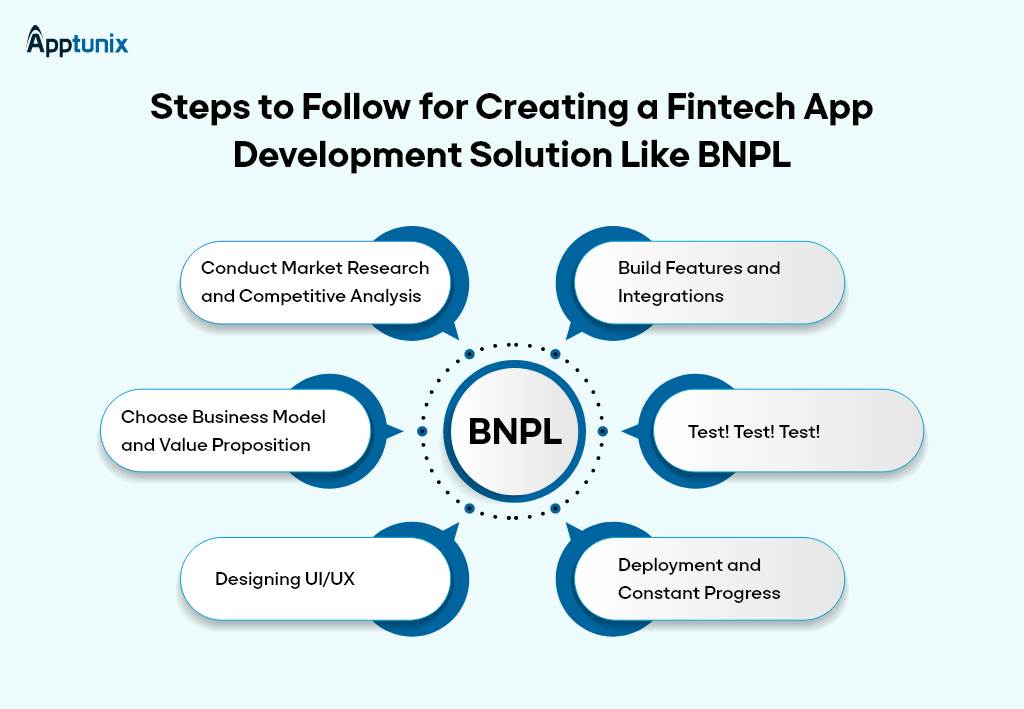

Although, developing a Buy Now, Pay Later app involves a structured approach from ideation to rolling out, these aspects are crucial in catering to market needs and regulatory compliance. Here are the steps:

Carrying comprehensive market research and competitor analysis is paramount at the onset of Buy Now, Pay Later app development. This step helps in understanding the customer requirements, market trends, and potential competitors.

Besides, it provides critical insights that shape the app’s features, Unique Selling Proposition (USP), positing, ensuring it fills in the gaps left unaddressed.

Picking the right business model and value proposition carries paramount importance when creating a BNPL app. This step includes defining revenue generation strategies along with user benefits, and curating its market viability and appeal.

Weaving user interface and experience is a vital aspect of BNPL app development. This step focuses on creating an engaging and interactive interface that improves user satisfaction. To deliver an unparalleled user experience, this step involves meticulous planning, user testing, and iterations, ensuring the app is both – eye-pleasing and easy to use.

Establishing features and integrations have direct impacts on buy now pay later app development. This step circumscribes integrating crucial features, employing payment gateways, and e-commerce integration. Also, it ensures secure transactions and e-commerce platform integration, supporting the app’s operational efficiency.

Testing is an imperative aspect of fintech app development services.

In BNPL app development, quality assurance and security testing are of paramount importance. It includes rigorous evaluations ensuring the app’s functionality, performance, and security with defined standards.

In essence, the testing step identifies and addresses concerns before launch, assuring a trusted and secure user experience.

Deployment marks a crucial milestone in the BNPL app development process, but this is not the end. Post-launch, regular improvements grounded on user feedback and ever-evolving market trends are inescapable. This way, you ensure the app remains competitive, relevant and responsive to customer requirements and technological advancements.

Finally, partnering with a trusted fintech app development company ensures the successful launch and operations of a BNPL app all while developing a dynamic, user-friendly and secure platform.

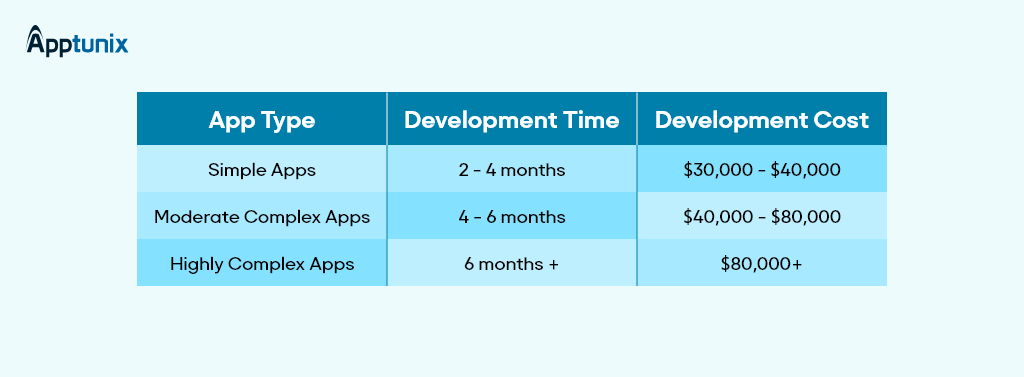

The BNPL app development cost depends on various factors and there’s no fixed amount. So, the development factors include project’s complexity, features & functionalities, UX UI design, tech stack, and more. However, the estimated development cost of BNPL app ranges from $12,000 to 120,000 or above (depending on the complexity of your project)

Here’ the overall development cost of BNPL App depending on your app’s types:

| App Type | Key Features | Estimated Cost (USD) | Development Timeframe |

|---|---|---|---|

| Basic BNPL App | • User registration • Product catalog • Cart & checkout • Payment gateway integration |

$25,000 – $50,000 | 3–6 months |

| Mid-Level BNPL App | • All basic features • User profiles • Installment options • Basic analytics • Customer support chat |

$50,000 – $100,000 | 4–8 months |

| Advanced BNPL App | • All mid-level features • AI-driven credit scoring • Real-time fraud detection • Merchant & admin dashboards • Multi-platform support |

$100,000 – $250,000+ | 6–12 months |

Building a BNPL (Buy Now, Pay Later) app doesn’t have to be expensive if you start with an MVP (Minimum Viable Product). An MVP focuses on delivering only the core features necessary to solve users’ problems, allowing you to validate your idea without overspending.

1. Identify Core Features

For a low-cost BNPL MVP, include essential functionalities such as:

User registration and authentication

Product catalog and cart integration

Basic payment gateway integration

Installment or flexible payment option

Simple admin panel to manage transactions

You can skip advanced features like AI-based credit scoring, real-time fraud detection, or multi-platform support initially and add them later after validating user demand.

2. Use Cross-Platform Development

Using frameworks like Flutter or React Native allows you to build your app for both iOS and Android simultaneously, reducing development costs and time.

3. Integrate Ready-Made Solutions

Instead of building everything from scratch, leverage third-party APIs for payments, credit checks, and notifications. This approach speeds up development and lowers costs significantly.

4. Test Early with Real Users

Launch your MVP to a small group of users or select merchants to gather feedback, identify pain points, and make improvements. This ensures your full-featured app meets market needs and reduces the risk of costly mistakes.

5. Scale Gradually

Once the MVP gains traction, you can gradually add advanced features like AI-driven credit scoring, fraud detection, loyalty programs, and analytics dashboards. This staged approach optimizes costs while building a scalable, high-value BNPL app.

Here are some helpful cost optimization strategies to consider for fintech app development like the Buy Now Pay Later app.

Utilizing open-source technologies is a cost-effective solution for minimizing expenses related to software licensing and proprietary solutions. Besides, by leveraging open-source frameworks and tools, businesses can easily step into a dynamic community support system, minimizing the need for exclusive tailored development.

To address development complexities seamlessly, agile development is curated as the most flexible approach. It consists of breaking down projects into small, iterative cycles, allowing for regular feedback and adjustments.

This approach is also termed “test-and-learn” as it identifies issues at an early stage, preventing expensive rework all while assuring a smooth and efficient development journey.

Despite being a startup or a flourished business, outsourcing BNPL app development to regions with talented and skilled resources and minimal living costs proves to optimize costs. These regions provide the best development quality at a significantly lower price compared to high cost-per-hour.

Therefore, by choosing an outsourcing development partner with precision, businesses can unlock significant cost savings without compromising on quality and timeline.

Building a Buy Now, Pay Later (BNPL) app requires more than just coding skills — it demands expertise in financial technology, secure payment integrations, and seamless user experiences. Apptunix, the No. #1 FinTech app development company combines years of mobile app development experience with a deep understanding of fintech trends, enabling us to deliver robust, scalable, and market-ready BNPL solutions. Our team ensures your app not only functions flawlessly but also drives user engagement, merchant adoption, and revenue growth from day one.

By partnering with Apptunix, you gain more than a development team — you gain a strategic ally committed to helping your BNPL business thrive in a competitive market.

End-to-End BNPL App Development: From concept to launch, we handle design, development, testing, and deployment across iOS and Android.

Secure & Compliant Payment Solutions: Integration with PCI-compliant gateways and fraud prevention systems to ensure safe and reliable transactions.

Customizable Installment Plans: Flexible repayment structures tailored for your target audience, increasing conversion rates and merchant adoption.

AI-Driven Insights & Analytics: Predictive analytics and user behavior tracking to optimize performance and increase revenue.

Scalable Architecture: Our apps are built to grow with your business, supporting more users, merchants, and features seamlessly.

User-Centric Design: Intuitive interfaces and smooth navigation enhance customer satisfaction and retention.

Post-Launch Support & Updates: Continuous monitoring, maintenance, and feature upgrades to keep your app competitive and relevant.

Market & Growth Strategy Support: Guidance on launch strategies, app store optimization, and user acquisition, helping your BNPL platform reach the right audience quickly.

With Apptunix as your partner, you get a future-ready BNPL app that balances technology, compliance, and growth strategy — ensuring maximum adoption, revenue, and long-term success.

The introduction of Buy Now Pay Later reveals a climate of opportunities and challenges alike. However, businesses should understand the intricacies of fintech app development services, like risk management, regulatory compliance and improved user experience within the financial ecosystem is important for apps to work for both customers and businesses.

With BNPL space gaining momentum every moment, hopefully, this blog will have provided you insights about the mechanics and inspired you to understand the nitty-gritty to thrive in the dynamically evolving sector of fintech app development solutions. Get in Touch with us at Apptunix, understand that knowledge and adaptability are the keys to turning ideas into a successful reality.

Our bespoke experience and the success of notable Fintech projects, consisting of APZ Sign, Webull Pay, PayBy drive our development processes. These projects stand as a testament to our team’s potential in navigating the complexities of financial app development catering to high standards of quality and innovation.

Q 1.What is a BNPL (Buy Now, Pay Later) app?

A BNPL app allows customers to purchase products or services instantly and pay for them later in installments, either interest-free or with minimal interest. These apps act as flexible financing tools integrated into eCommerce platforms or used as standalone services.

Q 2.How does a BNPL app make money?

BNPL apps generate revenue through multiple channels, including merchant fees (commissions from retailers per transaction), interest fees on delayed payments, late payment penalties, and sometimes through partnerships or advertising.

Q 3.What are the key features of a BNPL app?

A successful BNPL app typically includes features like user registration, credit assessment tools, real-time installment calculation, payment reminders, secure payment gateways, integration with eCommerce platforms, and fraud detection systems.

Q 4.How much does it cost to develop a BNPL app?

The development cost for a BNPL app can vary widely depending on factors like complexity, features, platform (iOS, Android, or both), geographic location of your development team, and integrations required. On average, it may range from $12,000 to $120,000 or more for a full-featured solution.

Q 5.Is it safe to build and operate a BNPL app?

Yes, BNPL apps are safe as long as they implement strong security protocols such as end-to-end encryption, PCI-DSS compliance, two-factor authentication (2FA), and advanced fraud prevention mechanisms. Ensuring regulatory compliance based on your target regions is also essential.

Q 6.How long does it take to build a BNPL app?

(1 ratings, average: 1.00 out of 5)

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Book your free consultation with us.

Book your free consultation with us.