Don't miss the chance to work with top 1% of developers.

Sign Up Now and Get FREE CTO-level Consultation.

Confused about your business model?

Request a FREE Business Plan.

How to Start a Financial Technology Company in 2021?

Since the pandemic knocked on our doors, the rise of financial technology companies has only accelerated due to the world relying on online transactions and digital ways of managing money.

Also, due to remote operations still staying in place, the incredible growth experienced by financial tech products in the last year can be expected to continue. From retail to digital banking and stock investment, it looks like fintech will only boom in the years ahead.

Given the situation, if you are trying to establish a financial technology company in such trying times, opportunities are surely endless. However, you may encounter a few challenges as well to establish your dream startup.

Before we talk about these challenges, let’s put the spotlight on opportunities and find out why Financial software development stands out for budding entrepreneurs who dream of establishing a billion-dollar startup in 2021 or years ahead.

Why Start a Financial Technology Company in 2021?

The time when you had to carry cash in your pocket when going out shopping is long gone. The Fintech industry which was almost unknown a decade ago is now transforming the way businesses are conducted. Today, it is one of the most lucrative industries for entrepreneurs as well as investors. Here’s why:

1. Fintech Funding Trends are On Fire (Even in Pandemic)

The industry which was once referred to as an emerging sector is now an undeniably crucial category in financial and business services. Despite being a comparatively young industry (in terms of time), fintech has become an independent and pandemic-proof sector with its own regulations and terms. This sector has secured enough capital over time to expand vertically as well as horizontally in the coming years. The numbers of development in this industry are only multiplying even in tough times like COVID.

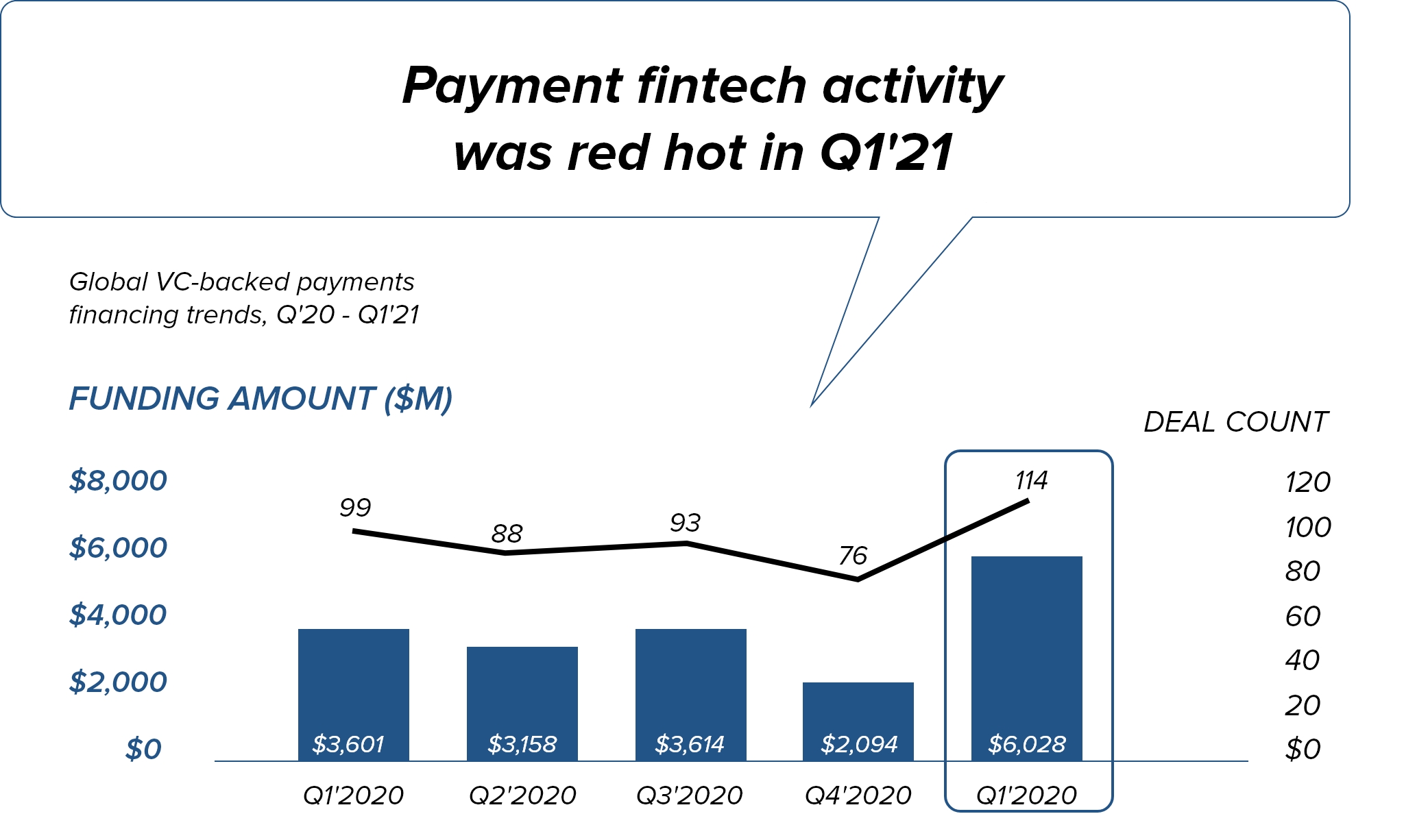

Despite being in the middle of a pandemic, investors are still backing large deals in the fintech industry, with the first quarter of 2021 already setting the records for total mega-rounds in a quarter. In Q1’21, fintech firms raised $22.8 Billion in funding through 614 deals, which is double the amount raised in Q4’20.

As per CNBC, the first quarter of 2021 was the biggest venture capital-backed fintech funding quarter ever. However, not all sectors participated equally in the funding growth. The largest levels of funding were seen in digital payments followed by digital lending, and wealth management sectors.

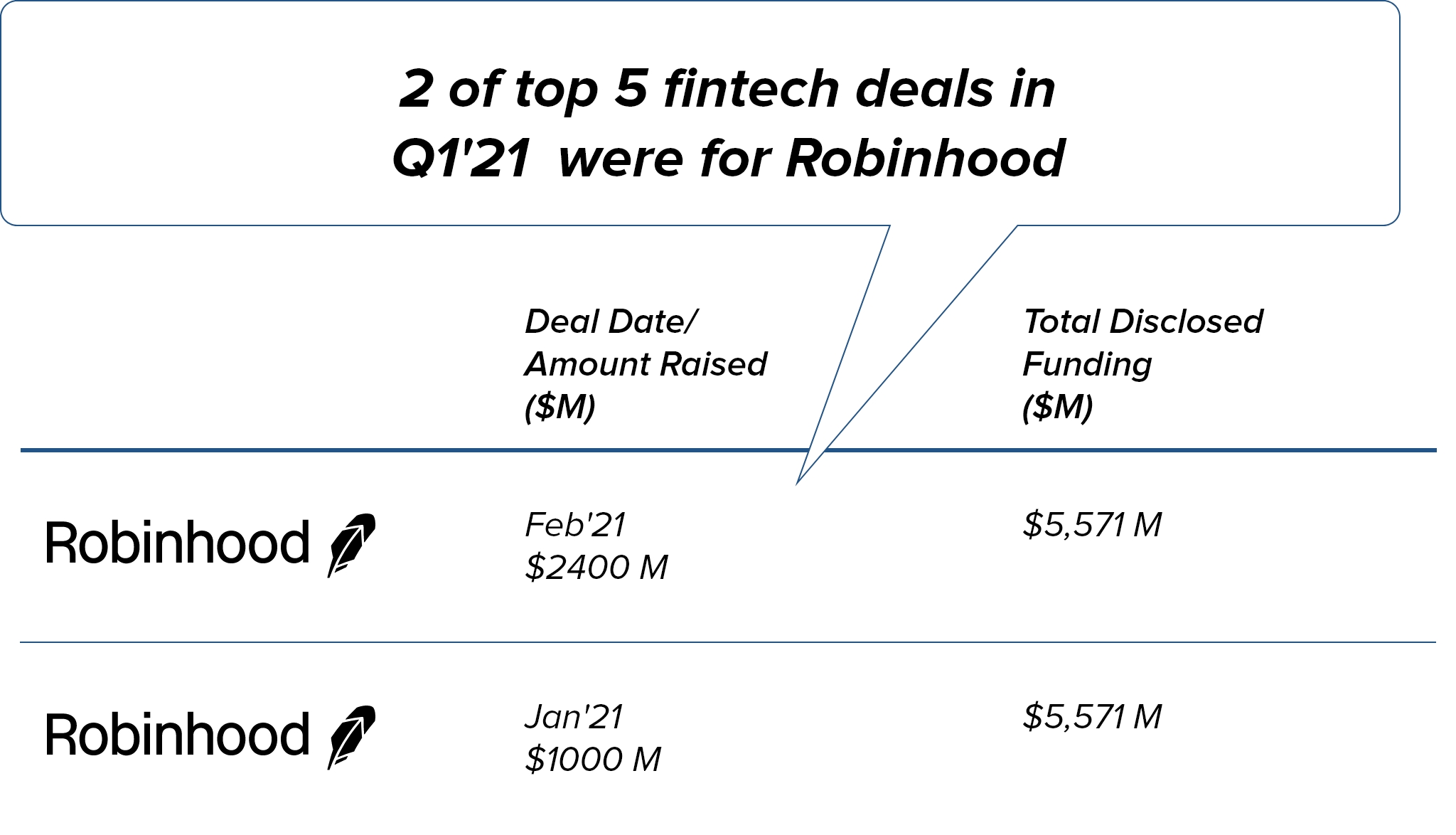

The most well-funded financial technology company in Q1’21 was Robin Hood, with $5.6B altogether equity funding. The San Francisco-based Robinhood – a stock trading application – saw a burst in retail investors in the midst of the pandemic, backed by pandemic-induced investor boredom.

2. The Global Fintech Market is Expected to Grow at a CAGR of 23.58% (2021-2025)

The global fintech market is expected to boom in the coming five years. The major factor behind this expected growth is increased investment in tech-based solutions by big investors and brands. On top of that, rising internet penetration, the popularity of digital payments, increasing investments in technologies like blockchain, and mind-blowing growth of eCommerce are expected to drive the immense growth of the fintech market.

The worldwide fintech market was worth $111,240.5 Million in the year 2019, after growing at a CAGR of 7.9% since 2015. As per reports, it is now expected to grow at a CAGR of 23.58% from 2021 to 2025, giving rise to several financial technology companies.

3. The Global Landscape is Changing from Physical to Digital

There is no uncertainty that the fintech industry is approaching 2021 with a totally unique mindset to the one it had in previous years. The pandemic has on a very basic level changed how organizations assess their future methodologies going ahead into another decade.

All through 2020 we heard that the pandemic is “speeding up” digitalization. While that might be true, it has also uncovered the areas in desperate need of progress. Can the same advances that kept things ticking over for as long as ten or twenty years be trusted to get them through 2021? Consumers have already moved their inclinations from the physical to the digital. Cash and cheques are almost out of style and digital payments are already the new trend.

Those same changing consumer preferences along with huge potentials of the fintech industry will attract a number of entrepreneurs to the bandwagon. Therefore, no doubt the competition will be immense but the huge return after establishing a winning Financial Technology Company will make it all worthwhile.

4 Steps to Build Your Financial Technology Company

Now that we have seen why it is the right time to invest in Fintech and how big is this industry, it is clear that to win this space, you need a strong approach. Just having the right intention won’t drive the billion-dollars you see when you hear the word Fintech.

So, let’s get started and see what is the right way to set up a financial technology company that makes a difference in this booming market:

Step 1: Select Your Niche

There are several models that have emerged in the fintech industry, ranging from mobile wallets to insurtech, and regtech. So, to start your fintech startup, you must decide your niche first. In this article, we will discuss the top six financial technology or fintech startup ideas for 2021.

1. P2P Payment Solutions

One of the most prominent niches in the fintech industry is P2P or peer-to-peer payment systems and apps like Paypal, Venmo, and Cash App. They let users send money to each other using their mobile devices through a linked bank account. One of the most prominent examples of such apps is PayPal.

Example: PayPal

Though PayPal offers a wide range of services to its users from online purchases to eCommerce, its main function is payment services for online buyers and merchants locally as well as internationally.

Apps like Paypal make money mainly by processing customer transactions and from value-added services. Therefore, the revenue stream is divided into two categories – transaction-based revenue and value-added services.

It makes money through partnerships, gateway fees, subscription fees, referral fees, and services offered to buyers and merchants. The company also charges interest on its portfolio of loan receivables, as well as interest on specific resources underlying customer balances. PayPal’s revenue from other value-added administrations fell 8.2% to $1.5 B in 2020, comprising 7% of complete business revenue.

2. Stock Investment Apps

Applications for assets and stock trading are some of the hottest fintech app startup ideas in today’s modern digital world. Investment and trading apps utilize a blend of AI, Machine Learning, and blockchain technology to drastically improve trading results. One of the examples of such apps is Robinhood – the hottest startup in the Fintech Market these days.

Example: Robinhood

Robinhood is a free-trading app that allows investors to trade stocks, exchange-traded funds, and cryptocurrency without paying any fee or commissions. The application’s USP lies in commission-free selling and purchasing of stocks. You are permitted to trade in a split second free of charge after you register in the app.

The app provides an easy explanation of the stock market that permits all types of individuals (novice or experts) a chance to make calculated investments and money.

If we talk about the funding trends in stock investment apps, it would be right to say that as of now it is booming. Out of the top five fintech deals closed in the first quarter of 2021, two were for Robinhood. During the pandemic, the app gained immense interest and investment from investors and is currently valued at more than $20 Billion. The app’s major revenue sources include revenue from interest, premium subscriptions, and interest on margins.

3. Insurtech apps

Insurance has long been tied to the finance sector. Now that finance has become fintech, insurance also upgraded itself to Insurtech. These companies range from simple websites that provide insurance to complex applications that can assess users using emerging technologies like AI and ML to offer a suitable insurance plan for them. The tech in insurance is helping companies optimize the customer experience. Rather than calling an agent, a user can now plan a claim online.

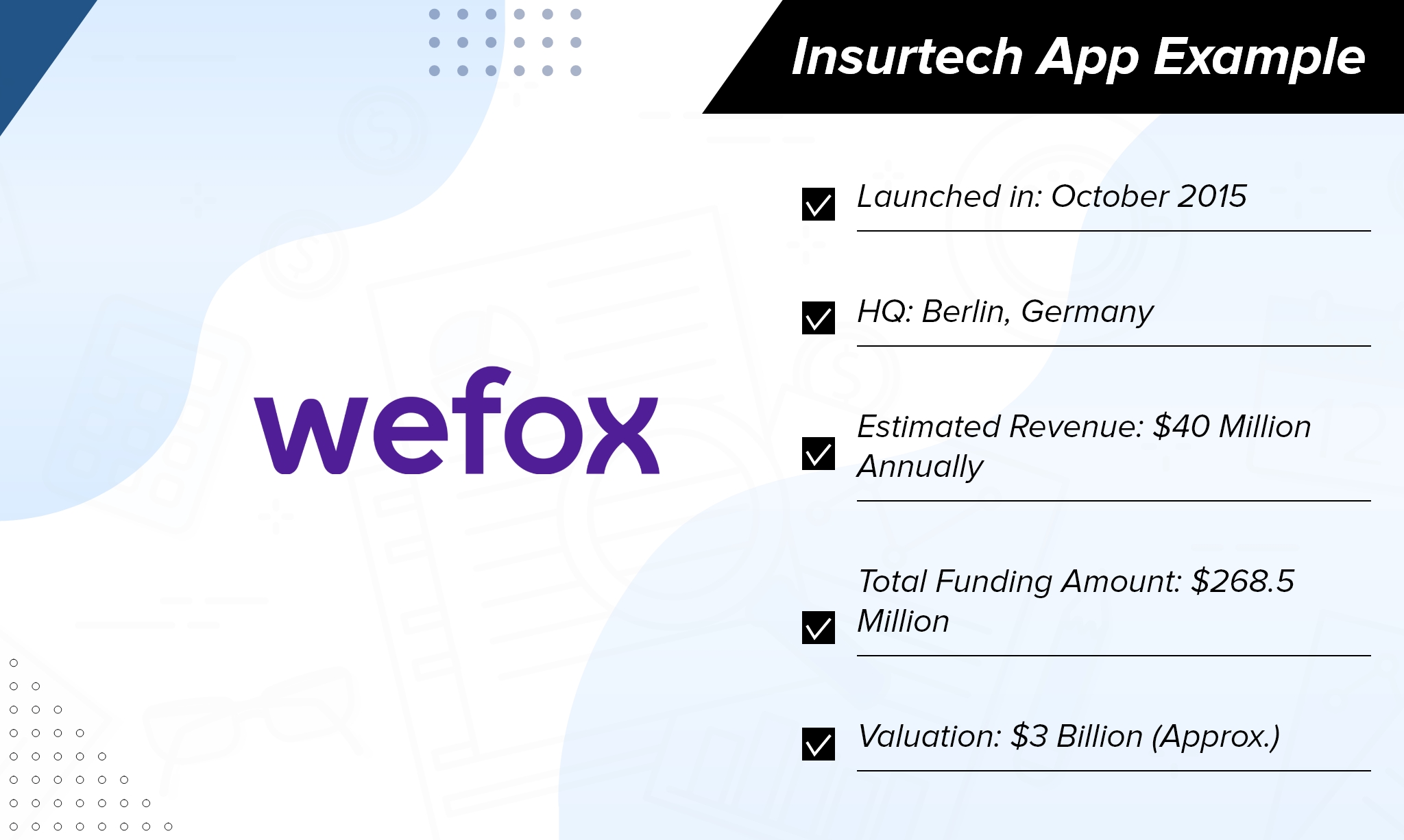

Some insurance software even uses AI and ML to anticipate and analyze risks and encourage safe lifestyles. Because of its immense benefits, the worldwide insurtech market, which was worth $1.5 Billion in 2018 is expected to grow with a CAGR of 40.3% in the coming years. Also, funding trends are booming in this sector, a real example of which is WeFox – the app recently raised $650 million in funding at an almost $3 billion valuation.

Insurtech App Example – WeFox

Wefox is the fastest growing insurance agency in Germany. Also called Wefox Group, the insurtech startup uses technology to connect customers, insurance providers, and distributors.

The revenues of the organization have developed to roughly $40 million yearly. It serves more than 400,000 users right now, alongside more than 1,500 insurance agents and this makes it the best insurtech platform in Europe, as per its CEO, Julian Teicke.

4. Consumer Finance Apps

Finance applications make your life simpler by assisting you with managing your funds proficiently. A personal finance application won’t just assist you with planning and managing but will also provide you insights on money investment.

It will help users with several investment alternatives, insurance inputs, tax advice, along with a proper security system. Utilizing fintech applications of this type, users can plan their expenditures ahead of time.

There are many types of financing apps ranging from simple to complex. Simple financing apps work on manual inputs to help track income and expenditure while complex financing apps also allow users to link their bank account through which data is synchronized. There are many ways to monetize such software, including in-app purchases, in-app ads, subscriptions, and integration with third parties.

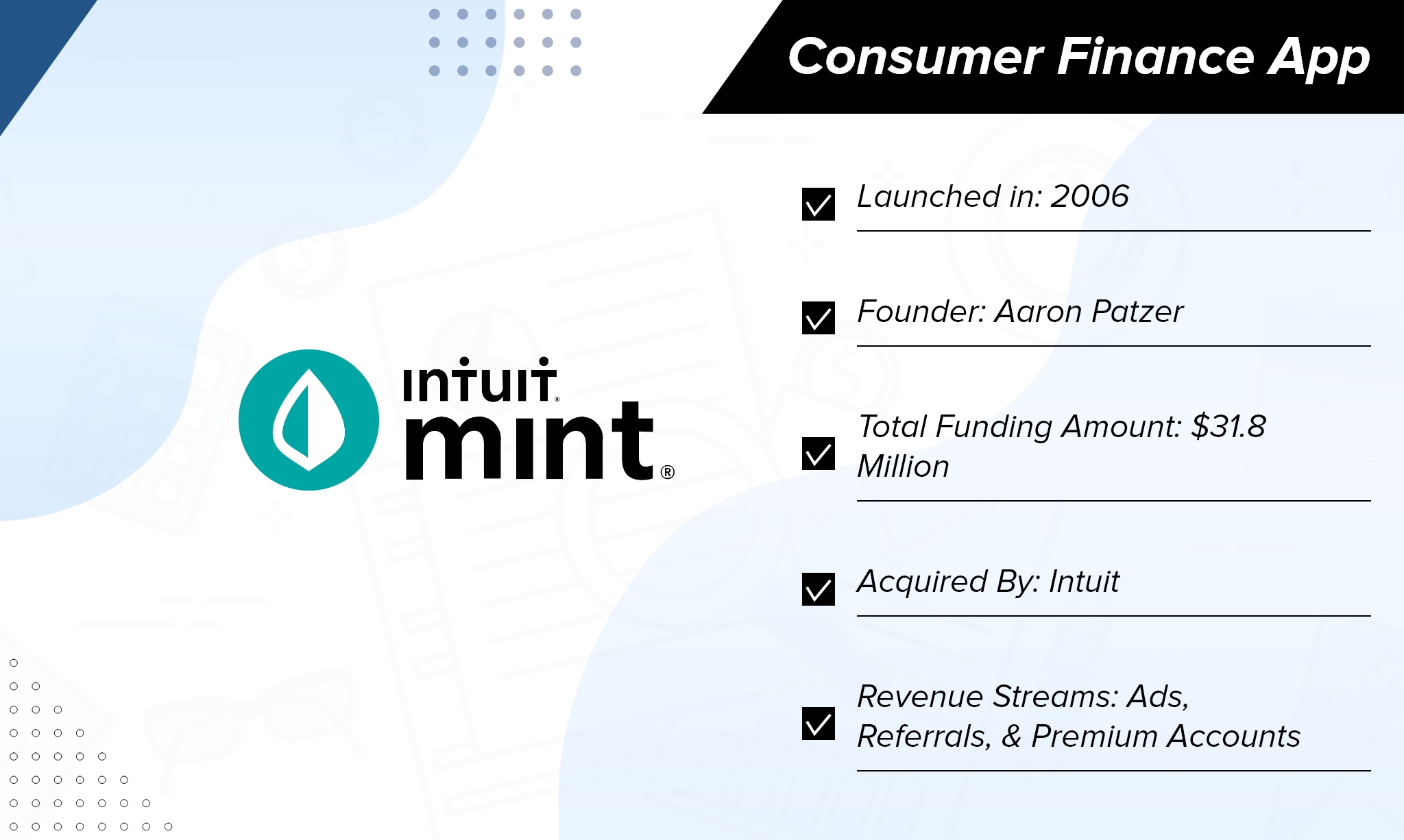

Example: Mint

Mint is a Financial Technology Company that collects data from various financial accounts and helps users manage their personal finances. Some of its features include sending alerts about ATM transactions, unusual spending habits, payment reminders, free credit scores, and bill payments. Along with acting as a money management tool, Mint also connects its app users with other financial providers.

The app makes money through referral fees whenever an app user purchases any of the products promoted by the company. It was founded in 2006 and is known for its amazing marketing campaigns and strategies. Right after three years of its inception, the company was acquired by Intuit for a whopping amount of $170 Million in 2009.

5. Mobile banking apps

Today, users prefer digital banking to get speedy and hassle-free access to banking services. High market demand has set the bars high for digital-only banks and the need to maintain social distancing has made them the most ideal choice during the pandemic.

Because of increased demand, traditional banks like Bank of America, Wells Fargo, and Huntington Bank have also developed namesake mobile banking applications and are rivaling newbies. Normally, a fintech banking application provides users digital access to tasks like opening and closing accounts, making digital transactions, ordering credit cards, etc. It likewise incorporates AI chatbots for monetary advice and quick consultation.

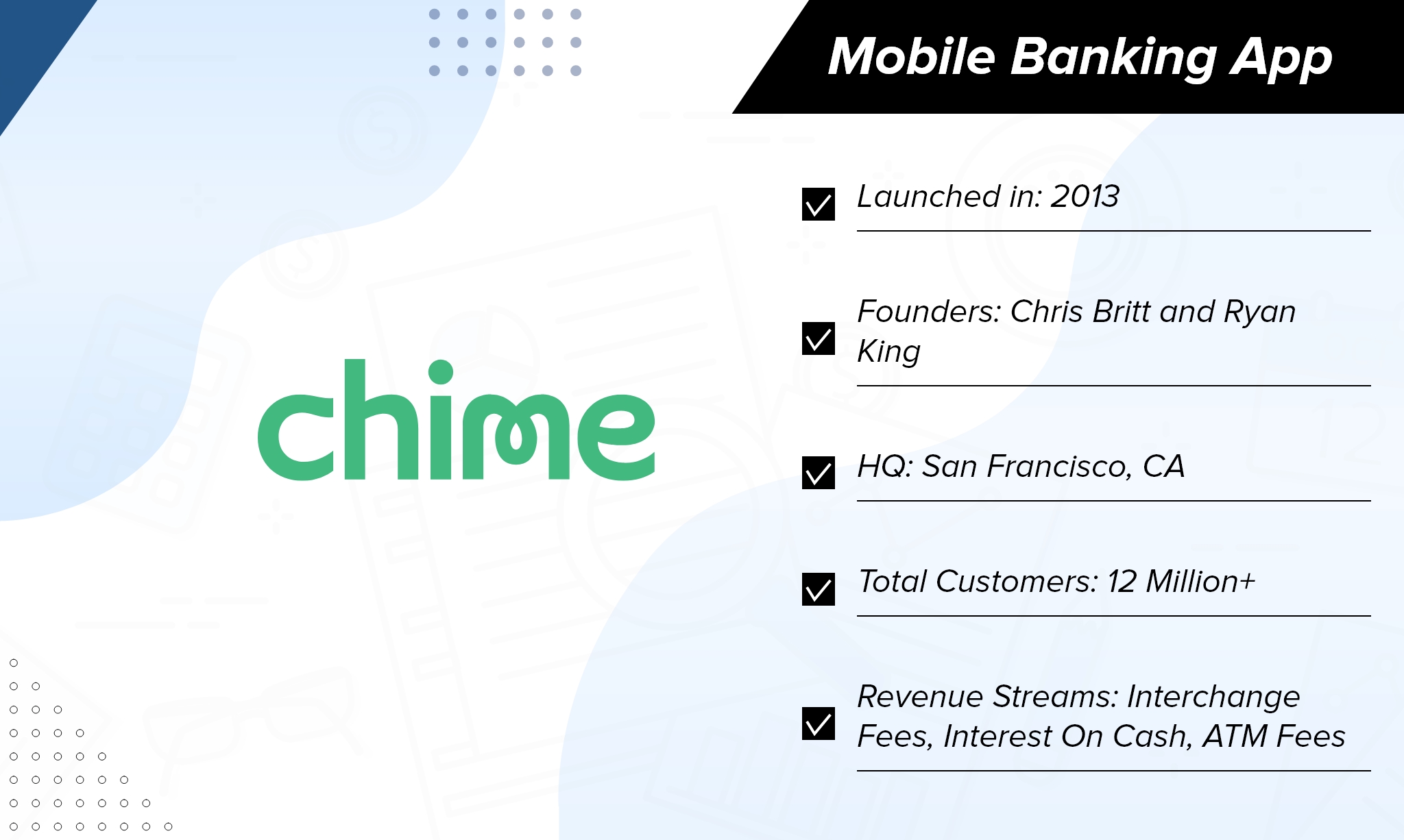

Example: Chime

Chime is an American-based neobank that provides several monetary products through its mobile applications. As a digitally empowered platform, Chime doesn’t operate through any physical branch. The application accompanies a physical Visa debit card.

Established in 2013 by technology and banking executives, the organization has seen a persistent increase in user growth. Today, Chime serves more than 12 million users that conduct around 40 transactions each month. The startup makes money through ATM fees, interchange fees, and interest earned on cash.

6. Cryptocurrency Wallet

These platforms are offering users a chance to venture into the decentralized market by trading cryptocurrencies for other resources like fiat money or other digital currencies. In other words, they are allowing users to trade one digital currency for another, receive crypto tokens in return for fiat money, and even purchase/sell their crypto coins. All while enjoying advantages like lower expenses, transparency, higher security, and faster processing.

Example: Coinbase

Coinbase is an online marketplace that permits users to trade different digital currencies. All the more explicitly, users can purchase and sell more than 20 different digital currencies on Coinbase, including Bitcoin, Litecoin, Ether, XRP, and numerous others.

Aside from trading, the company provides solutions that permit clients to store resources, utilize a Coinbase credit card, learn about cryptos, or permit your online store to accept crypto payments. The business model of Coinbase is focused on the expenses it charges for exchanging digital currencies. Other modes of generating revenue include Coinbase Pro & Prime, Cashback, Interest On Cash, and Interchange Fees.

Established in 2012 and based out of San Francisco, the organization has become the first widely embraced cryptocurrency startup. Find out more about Coinbase in our comprehensive guide on “How Apps like Coinbase Earns“.

Step 2: Get to know the Regulations

Now that you know the niche and business model of your fintech startup, it is time to put your plan into action. But, fintech is a sector where you need to take every step carefully as you will be managing people’s money in one way or the other while doing so.

Fintech has many such rules and regulations that need to be followed by all kinds of startups. Prior to starting a Fintech startup, you should find out about the laws concerning regulatory authorities, limitations, and legal requirements of all the countries where you plan to do the business.

If you provide your Fintech application and services to individuals from more than one country, your Fintech startup needs to comply with the guidelines of every one of those countries. Some of the largest financial service providers across the globe have been subjected to heavy fines for not complying with laws and regulations of the land.

Here are some of the basic steps you need to follow to avoid any type of fines in 2021:

- Investigate the amended laws from regulatory specialists

- Review your present identity verification protocols

- Guarantee robust KYC/AML compliance

- Never register any customer without verification

- Always perform EDD checks for high-risk clients

- Ongoing transaction monitoring should be done to avoid money laundering

Step 3: Hire Fintech Development Partners

The essential part of launching a fintech startup is not finance but technology that empowers it. You may have the complete information on the details of the finance world, but you need a similarly (if not more) proficient team of technical specialists to launch a successful fintech startup.

If you think hiring a team of developers in your home country would be a bit expensive, consider hiring development partners from any other country. This not just reduces massive expenses for cutting-edge startups, yet additionally provides a strong team of experts with explicit domain knowledge and significant experience.

If you are all set to develop your fintech product and are looking for a finance software development company, we can help you get a free quote and business plan analysis with the help of experts at Apptunix. Simply fill this form and we will reach out to you.

Step 4: Build an MVP and Raise Funding

Funding is the most significant and likely most troublesome part of establishing a financial technology company. You need to show the capability of your fintech app idea to acquire a substantial amount of funding. The only thing that can help you secure it, is a minimum viable product (MVP).

If you don’t want to spend all your money, consider building an MVP that you can show as a proof of concept (PoC) to potential investors when pitching for the funding.

With the funding that you get based on your MVP, you can develop a complete application or fintech software solution for your target market. That is how all big brands developed their products into multi-billion companies like Uber, Zomato, and Robinhood.

Wrapping Up

It may not be easy to establish your Fintech app development company. With every one of the hurdles on the way — it requires efforts, proper planning, and strong technology partners to thrive in this highly competitive market.

But, if you believe your idea has the potential to make a mark in this industry through innovative means, try it out and build the start-up of your dreams. Got queries? Schedule a call with one of our experts and we would be delighted to help you!

Rate this article!

(3 ratings, average: 4.33 out of 5)

Join 60,000+ Subscribers

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Nikhil Bansal is the Founder and CEO of Apptunix, a leading Software Development Company helping startups as well as brands in streamlining their business processes with intuitive and powerful mobile apps. After working in the iOS app development industry for more than 10 years, he is now well-equipped with excellent problem-solving and decision-making techniques.

Telemedicine 2.0 - A Comprehensive Guide On What Healthcare Providers Need To Know?

Discover how the latest advancements like Artificial Intelligence in telemedicine are reshaping patient care. This comprehensive resource offers insights into the key trends and innovations driving this shift, providing valuable knowledge for healthcare professionals looking to stay ahead.

Download Now!Subscribe to Unlock

Exclusive Business

Insights!

And we will send you a FREE eBook on 'Mastering Business Intelligence.