Don't miss the chance to work with top 1% of developers.

Sign Up Now and Get FREE CTO-level Consultation.

Confused about your business model?

Request a FREE Business Plan.

Ultimate Guide To Loan Lending App Development | Market & Cost

Table of contents

There are many reasons why this is the right time for loan lending app development. With the market economy on a rollercoaster, many projects regarding investments have either been postponed or canceled. We’re not referring to institutional investors here; many regular folks can provide loans to needy individuals or companies. This is what P2P loan lending is.

Lending money while lounging in your armchair is now possible, thanks to peer-to-peer lending apps and websites. In the Fintech industry, these apps are starting to become rather popular. Are you interested in learning how to set up P2P loan lending app development services? Read further!

What are P2P Loan Lending Apps?

P2P loan lending is also known as “person-to-person” or “peer-to-peer” loan lending. This phrase refers to lending and borrowing done directly between individuals rather than through traditional financial intermediaries. P2P lending is frequently carried out via specialized websites where users can act as both lenders and borrowers.

Users can obtain an immediate loan using the loan lending app, which functions like a credit card. Installing one of these applications and creating an account are the only requirements for users. After that, customers must confirm their eligibility and enter their personal and financial information.

These apps are now among the most trustworthy because they allow users to verify their reputation, credit score, and the amount of loan they qualify for. It cuts down on time spent traveling to banks, waiting in lines, and interacting with bank staff in person.

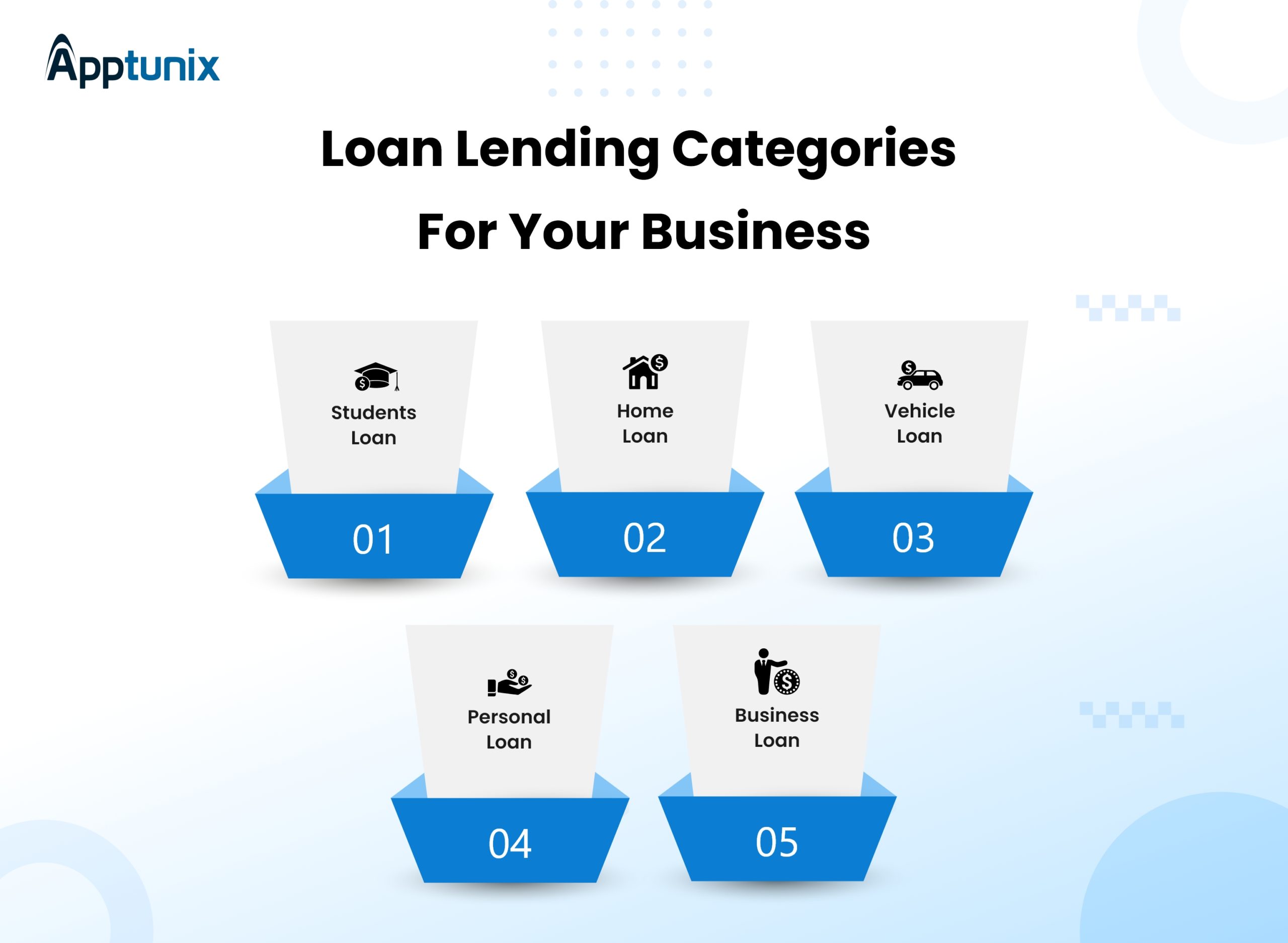

Loan Lending App Development Categories

The main thing that affects the loan lending app development process is the targeted audience. There are a lot of loans that many users choose to avail of. Partner with the best loan lending app development company that offers different loans.

1. Student Loans

Consider the fact that this group has a significant influence on loan lending mobile app development services if you want to offer the services in your area. Students borrow money to fund their graduate education. Simply admit yourself, present your credentials, and the loan will be approved. Such apps can be delivered to you with ease by our loan lending app developers.

2. Home Loans

You just need to concentrate on how to begin a loan application if you are prepared to help with mortgages. You can get creative, practical, and simple-to-use solutions if you hire mobile app developers at Apptunix. These apps enable you to reach a wider audience, and their user-friendliness makes it likely that users will spread the word about your app.

3. Vehicle Loans

With fast loan services, you can help your users indulge in life’s minor joys. All you have to do to get rapid car loan services is locate the most affordable loan lending mobile app development in India and enter the market with a product that may simplify things for you.

4. Personal Loans

These are the loans that have been explicitly obtained for personal use. These loans typically have higher interest rates because they are unsecured. Reach out to mobile loan app development service providers who can ease your burden if you’re interested in offering customers personal loans where you may charge higher interest rates and turn a profit.

5. Business Loans

You, therefore, want to aid entrepreneurs and startups in becoming better, larger, and stronger but you are unsure about how to make a loan lending app. Then all you have to do is get in touch with the loan lending app developer and provide him with the information. He would take care of the rest, including how to design a lending app that meets your demands.

Why Invest in P2P Loan Lending App Development

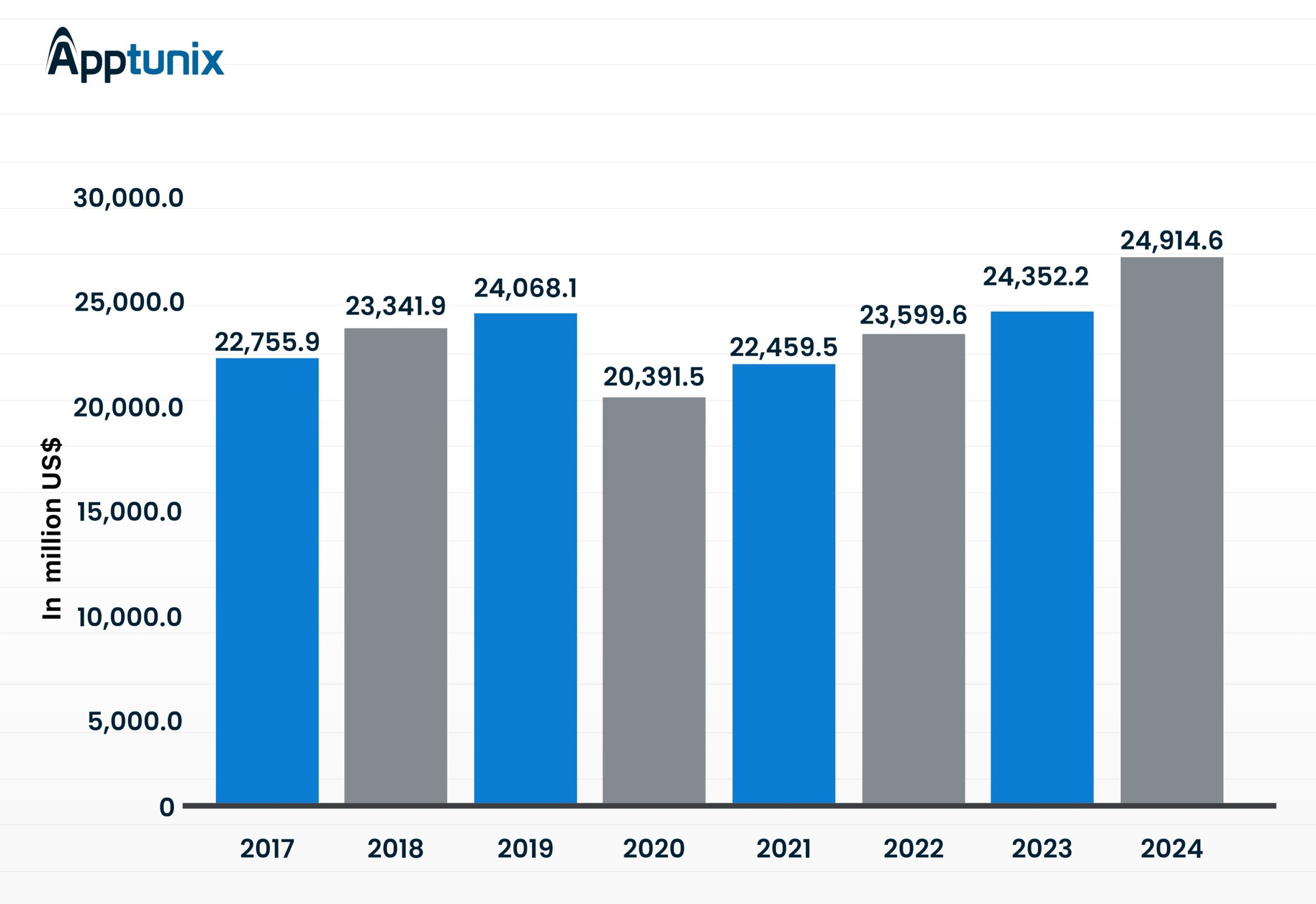

The Statista analysis predicts that the loan lending market will progressively see growth this year and that the transaction value in the marketplace lending category will increase to USD 20,391.5 million this year alone. By 2024, this market’s size will rise to USD 24,914.

Check out this graphical illustration of the same:

It is obvious that the number of mobile loan lending apps is steadily increasing. The research that was conducted in the United States in 2015 made this pretty clear. According to the study’s findings, 31% of respondents sought access to such apps because they would make the process of borrowing money quick and easy.

These are also well-liked because they offer solutions to a wide range of issues, including loan eligibility, interest rates, credibility checks, application acceptance, documentation, etc.

Legal Compliance & Encryption That You Must Know

These areas must be covered separately because they are essential if you wish to operate lawfully and stay out of trouble. Additionally, you must secure a loan application and website to prevent hacking by criminals.

1. Ensuring Fault Tolerance

Your P2P loan lending development needs to be fault-tolerant, therefore developers need to take it into account. It implies that it will continue to function even in conditions of high load brought on by numerous simultaneous actions. Developers must therefore utilize a unique tool that can handle fault tolerance.

2. Security First

Your website and mobile application should both be sufficiently protected against common dangers like XSS (cross-site scripting), SQL injections, the exposure of sensitive data, faulty authentication, etc. Any current encryption methods and signature technologies must be used in order to encrypt all user and lender personal information obtained from a third party.

Additionally, PIN numbers, passwords, and even biometric authentication should all be used for encrypted authorization across the board. Therefore, the security issue in this situation requires close attention.

3. GDPR Compliance

If you develop software for the EU market, you must ensure that your lending application complies with GDPR. The General Data Protection Regulation, or GDPR, went into force on May 25, 2018.

4. CCPA Compliance

If you create a loan lending app for California people, you must abide by the California Consumer Privacy Act (CCPA). Giving people more control over their personal data is the fundamental objective of this legislation. If California is your target market and the CCPA goes into effect on January 1, 2020, you must make your P2P loan lending app development CCPA-compliant.

Loan Lending App Development Model To Choose

To ensure the cost-efficiency of your loan lending app development, you must select the right development model. Here are a few things that will help you choose the best one.

1. Product Development

When you have the funding and the idea, but not the staff to develop the concept into a usable product, this strategy works best. The technology partner you select for the product development roadmap must offer the entire cycle of product development, from conception to design, coding, release, and continuing product support.

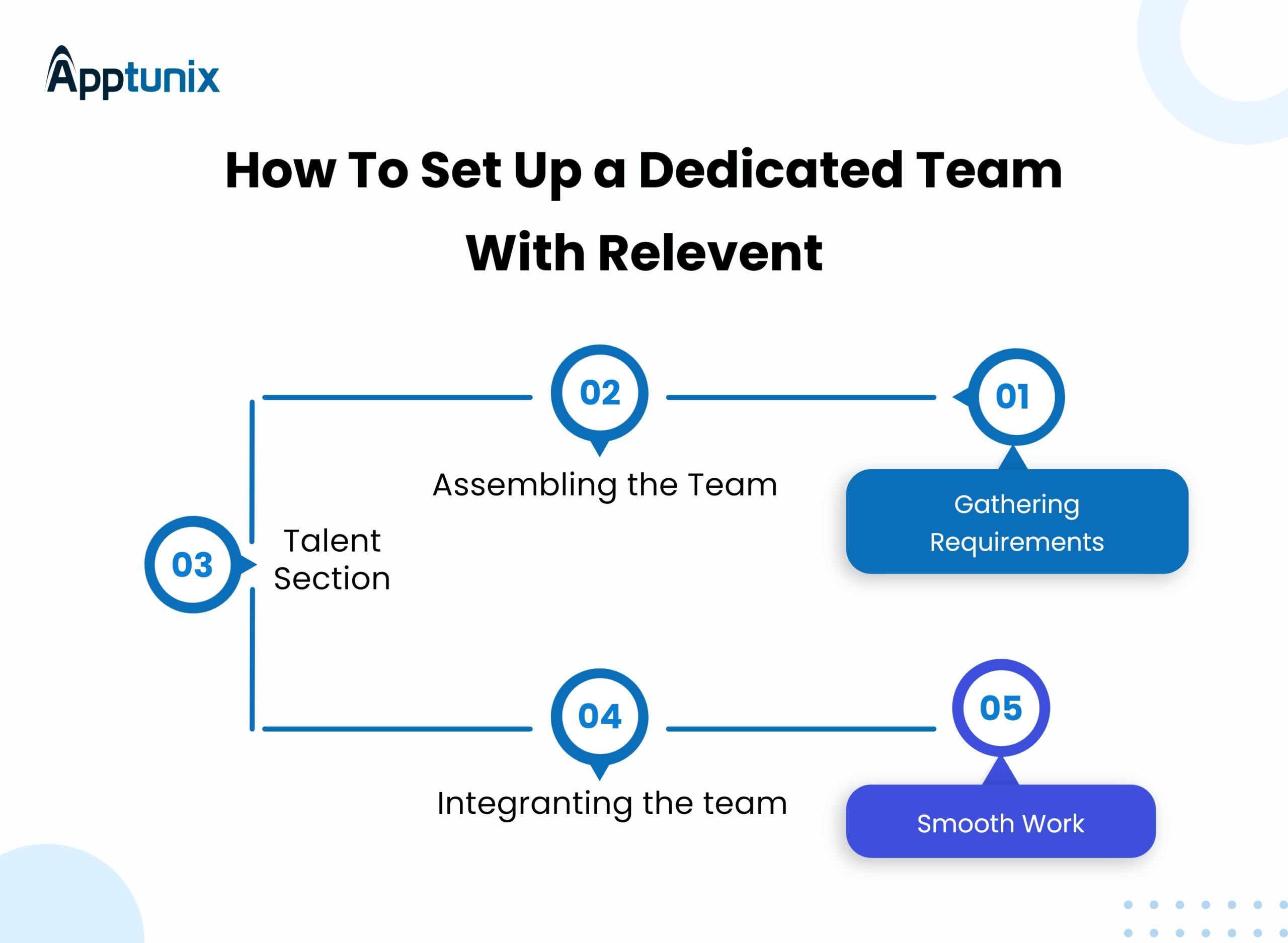

2. Dedicated Team

There are occasions when you have enough internal experience to begin developing an app but are unable to grow quickly enough or recruit the experts required to advance the development under pressure. The easiest method to acquire immediate access to the required skills and guarantee that software development and scaling follow the authorized plan is to hire a dedicated team.

Loan Lending App Development Stages

Here is the fundamental procedure that our professionals adhere to for loan lending app development. It will not only keep you constantly involved in the growth process and help you make huge profits, but it is also quick and easy on the wallet.

1. Idea

An amazing idea, which might originate from either you or us, is required in the process of building a firm. The author of the loan app will consider any ideas you may have and incorporate them along with our knowledge to create a widely used app for lending money that will generate significant profits.

2. Concept

R&D is important when a business is first launched. An accurate market study and user interface design are necessary to create a lending app that works well for your company. Our UI/UX Design team has a greater obligation to stand out from the competition.

3. Implementation

Apply the stages in accordance with the clients’ requests. Being open and following what best fits the features and functionality offered are essential. The emphasis of the custom solution is on including the features and capabilities that the clients request.

4. Quality Assurance

We test the app using cutting-edge techniques. The quality analysts and software testing specialists ensure that your program is error-free. Following thorough testing, you can be sure that the program will be free of bugs. Being accessible to the client is essential in case there are any issues.

5. Support

After a specific project has been delivered to the client, free support may be provided for a year.

When asked how to design money lending mobile app, we have an open and understandable app development method. This makes using our services more convenient for you. You would constantly be involved in the development process thanks to our agile software development methodology.

How Much Will it Cost?

The cost of a loan application is influenced by a number of variables. Although the mobile app development team engaged to build the app has a key part in determining the app’s price, there are other elements to consider as well, such as:

- The application’s complexity

- Features integrated

- The application’s architecture

- Location of the loan lending app development company

- Duration of app development

The application approximately costs between $30K – $100K depending on the functionalities you want to integrate like banking, payment options, etc.

Apptunix Expertise

Apptunix is one of the leading mobile app development companies having experience of more than 9 years in the industry. We keep extensive experience in Fintech app development and offer a wide range of services from custom mobile app development to legal support and maintenance.

- Our business analysts undertake in-depth research and provide a free project estimate.

- A track record of developing software from scratch in a variety of fields

- We ensure high-level data protection by adhering to best security practices and legislation.

- A range of adaptable collaboration structures that are appropriate in any situation: time and materials, a committed crew, and a fixed pricing

- Achieving the highest level of solution quality and full-cycle software development

- Complete team structure with all the necessary highly qualified specialists

- Innovative development methodology and state-of-the-art technology stack

Wrapping Up

Since there aren’t many loan lending apps available right now, there are opportunities for startups to put money into them. People are gradually switching from bank loans to easily available loans via mobile apps, so if you’re going to have one of these applications made for yourself, you might just stand a chance to stand out from the competition and win the competition.

All you need to do is partner with the best loan lending app development company, one that will pay attention to your idea and envision it while including the newest features and technologies.

Rate this article!

Join 60,000+ Subscribers

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Lively and spirited. You may call me a tech-geek. I like to explore latest advancements in the technical areas and develop case studies. Being a computer science graduate, I like to traverse through the technical platforms as well. You can find me understanding or playing with the latest technology.

Telemedicine 2.0 - A Comprehensive Guide On What Healthcare Providers Need To Know?

Discover how the latest advancements like Artificial Intelligence in telemedicine are reshaping patient care. This comprehensive resource offers insights into the key trends and innovations driving this shift, providing valuable knowledge for healthcare professionals looking to stay ahead.

Download Now!Take the First Step

Towards Success!

Master app development with a

30-day FREE trial of our premium

solutions.