Don't miss the chance to work with top 1% of developers.

Sign Up Now and Get FREE CTO-level Consultation.

Confused about your business model?

Request a FREE Business Plan.

Why Mobile Payment Apps Are Said to Be a Profitable Venture for 2025?

Table of contents

As the entire world is evolving due to the CoronaVirus outbreak, it seems like now is the time for another strategic shift in the world economy. And this shift will be introduced by people who are afraid of catching the virus from contaminated cash notes using Mobile Payment Apps.

While a number of countries like Sweden, China, and the UK are already embracing cashless payments completely, others are in the league. As per reports, in the US as well, around 46% of Americans are using smartphones to pay their bills.

Therefore, the path to cashless is extremely clear now!

With an increase in usage of smartphones, mobile apps with UPI, and e-wallets, the mobile payment market is flourishing, luring several entrepreneurs and investors to invest in it. It is also one of the few industries that survived the pandemic effect on the economy and emerged even stronger and profitable.

Are you wondering what’s making us say that? Let’s find out.

5 Stats to Prove the Billion-Dollar Worth of Mobile Payment Market

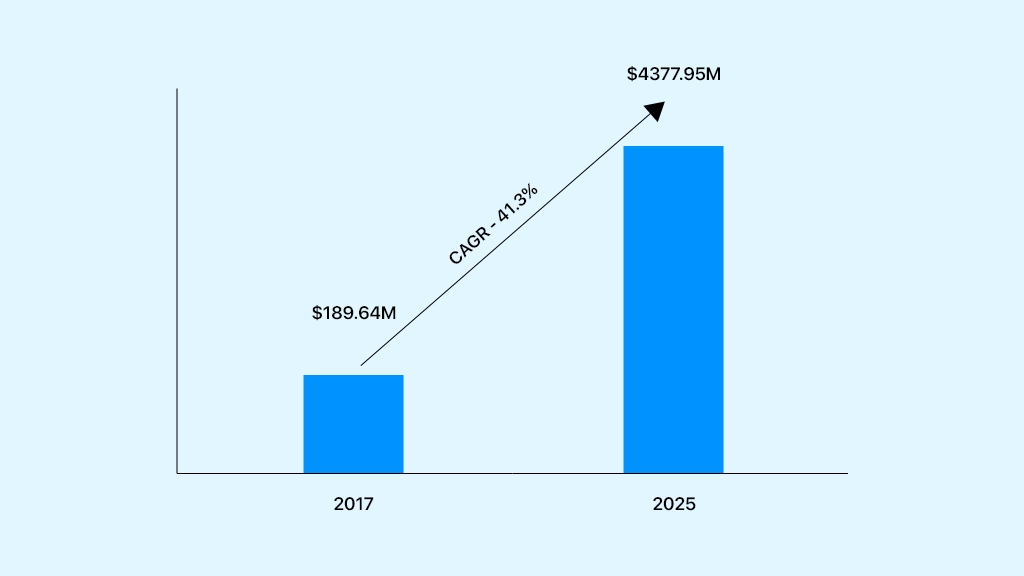

1. The Mobile Payments Market is Expected to be Valued at 4690.65 Billion by 2025

When entering any industry – it is crucial to check its potential and cash flow trends. Fortunately, if you are planning to develop a mobile payment app, you are good to go for the same. This market is continuously flourishing – it was valued at $1139.43 Billion in the year 2019 and is expected to grow to $4690.65 Billion by the end of 2025.

With consumers’ preferences changing from handling cash to pay in a tap – the services and stores around the globe are also quickly becoming mobile savvy by integrating payment apps like Samsung Pay, AliPay, PayPal, and others to accept payments.

Also, this trend doesn’t seem to vanish in the future as well. This is luring many entrepreneurs to grab the share of this growing market by building apps or digital solutions that make payments seamless. If you are one of them, try connecting with a mobile payment app development company and launch your app in the market before it gets too crowded.

2. Asia-Pacific is the Leading Market For Mobile Payment Apps

Although the entire world is embracing mobile payments, Asia-Pacific is progressively getting famous for the adoption of its electronic payment methods. Countries like Japan, India, and China are having a steady ecosystem in place for the growth of the mobile payment industry. Therefore, launching a digital payment solution in these countries would be a win-win situation for all.

According to Visa Inc., in Australia as well, out of all the transactions carried out in the last one year, 79% were carried through electronic medium and only 21% were in-cash. It says a lot about Aussies’ love for digital payments.

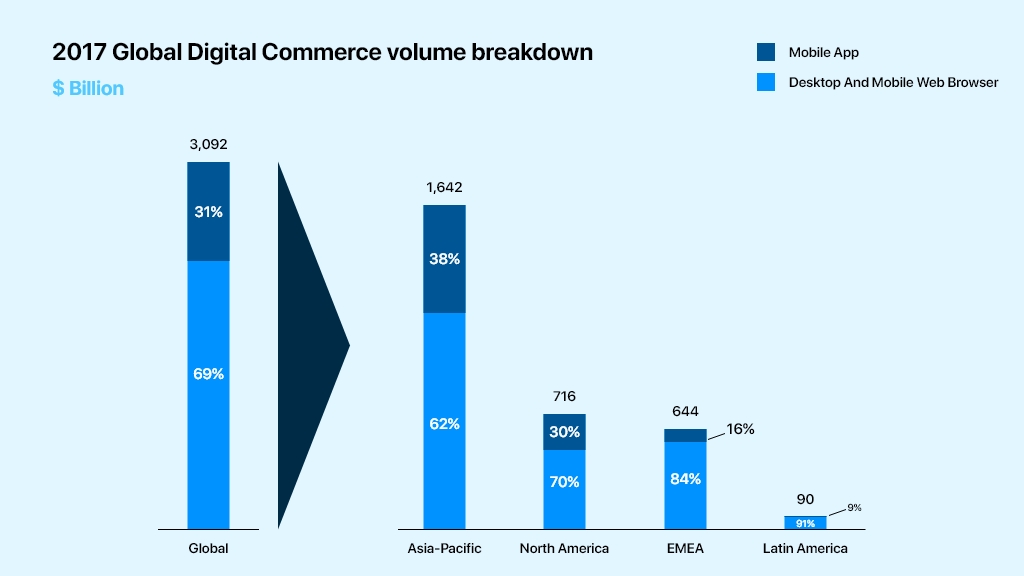

3. Mobile Apps Accounted for More Than 30% of Global Digital Commerce Volume in 2017

While consumers and store-owners are increasingly embracing mobile-based commerce and in-application payments, retailers are planning to invest in mobile payment apps developed using emerging technologies to provide omnichannel experience for customers.

As a result, mobile apps accounted for more than 30% of the worldwide digital commerce volume in 2017 and this number is expected to grow in the future as well across all regions. It is also stated in the same report that Digital wallets added approximately 40 Billion to worldwide payment revenues in 2017.

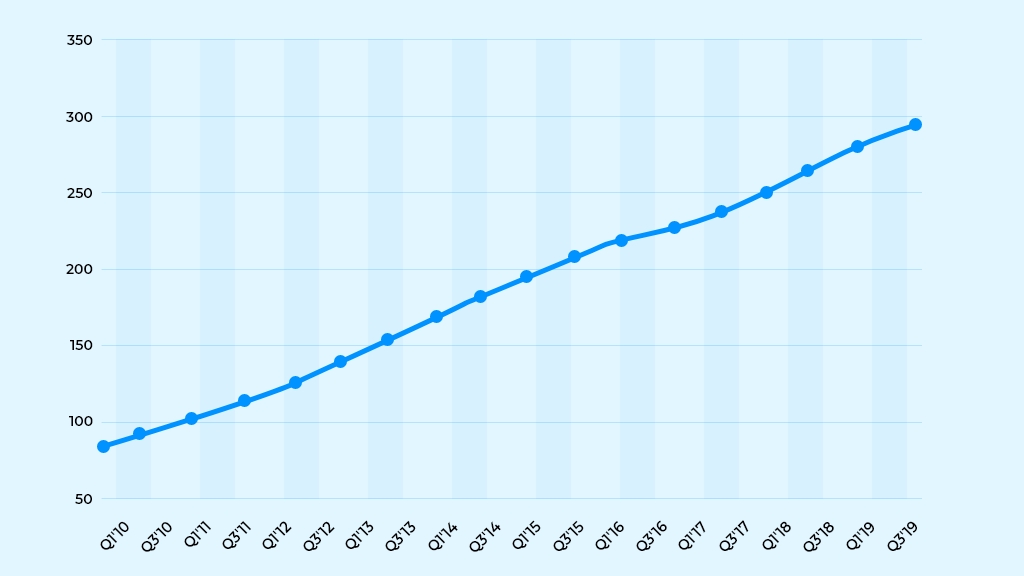

4. Mobile Payment App PayPal Generated $17.772 Billion in Revenue in 2019

With an amazing Revenue Model, Paypal – one of the best mobile payment apps worldwide generated a whopping amount of $17.772 Billion in Revenue in the year 2019. The company is known to maintain 15% revenue growth every year and the majority of its users belong to the USA. If you want to build a mobile payment app, you should surely dig into PayPal’s business and revenue model for some invaluable insights.

Have a look at the escalating number of active PayPal users:

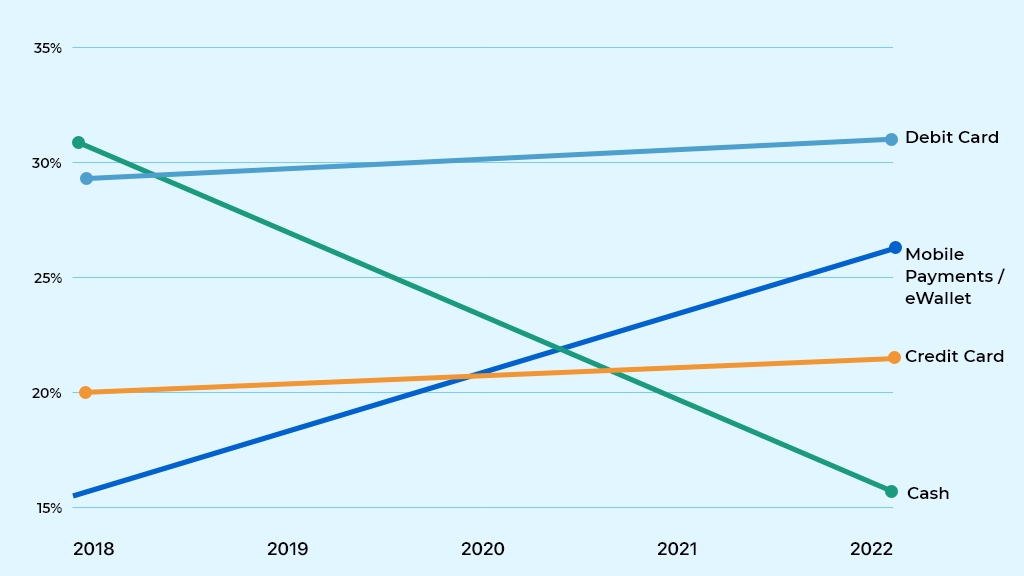

5. Global Use of Mobile Payments is Expected to Surpass Other Methods

According to a report by Mordor Intelligence, the use of mobile payment is set to increase with an annual growth rate of 26.93% between 2020-2025 as mobile payment apps like AliPay, SamsungPay, Paypal, and others are growing in terms of the number of users.

After seeing these Mobile Payment Market Statistics, it is quite evident that this industry is exploding like never before. Increased market size, the interest of users, and several new opportunities are attracting investors towards the mobile payment ecosystem.

And this is making budding entrepreneurs excited to know the new tactics and trends that they can use to be a part of this flourishing industry. So, let’s now explore the same.

What Does The Future of Mobile Payments Look Like?

As indicated in a recent report by Juniper Research, it is estimated that by 2024, up to 4 Billion consumers will have mobile wallets, which is a huge growth from the current 2.3 Billion users. After seeing such stats, the future of mobile payment technology looks very bright. Let’s now have a look at the ingredients of this bright future:

1. High-End Security In Mobile Payment Apps

A Mobile Payment App can only get success if its users can depend on its security structure.

Therefore, if you are planning to build an app for streamlining payments, it is your responsibility to guarantee user data security by using emerging technologies. Also, the future of Mobile Payment Apps lies in security as users are becoming more and more skeptical about their personal data these days. Here is how you can ensure your app is safe:

- Point-to-Point Encryption

This is an advanced security technique that shields the entire transaction from the start to the end. It begins encryption when you swipe your smartphone over PoS-terminal, then the transaction is initiated, and up to the approval. This kind of protection is included in the list of must-haves when building a mobile app for payments.

- Tokenization

Tokenization is an emerging technology that makes e-payments secure with the assistance of a solid information encryption framework. The purchaser doesn’t give the vendor their payment details while paying by a card. All card data is encoded and it is transformed into a token that looks like a random combination of symbols.

- Password

Obviously, a password is the kind of protection any application or site that contains personal data should have. It is smarter to include a rejection feature if the user creates a too simple or short password for his/her account. It will assist you with increasing the protection level in-app and will make it safer.

Additionally, biometric security can also be included. If the smartphone of the user is advanced enough and it has a scanner for fingerprints, your mobile payment application may require the approval utilizing biometric data.

2. Social Shopping

Let’s be honest, people like to be on their phones every time these days. They like to scroll through the feed on Facebook, Instagram, and several other social media platforms. With such a significant number of eyeballs on these apps, it’s just common that businesses endeavor to market to such a huge audience.

In the future, it is expected that when social users will find a product they like on certain social media platforms, they will no longer have to leave the app to purchase and pay for it. They will be able to simply do all that by just clicking on a buy now button and get what they want without leaving the app.

This smoothed out social shopping experience requires a dynamic, flexible, and adaptable mobile payment processor that can integrate with shopping cart and social media technology. This social shopping combination represents a fundamental capability for the future of mobile payment technology.

3. Mobile Point of Sale

People’s payment preference isn’t the only thing which is going mobile. With mPOS technology, the card related processes are going mobile too. mPOS units are the remote devices that are made to imitate the sale terminals and customary sales registers.

mPOS units offer a simple, without wire, space-sparing, and advantageous way for merchants to accept payments. mPOS units set merchants free to take payments from anywhere. Earlier, this was not possible because of the merchant’s in-store payment frameworks. With mPOS, there’s no requirement for a centralized checkout location.

The number of mPOS devices in 2014 was just 3.2 Million, which are evaluated by Business Insider to go up to 27.7 Million by 2021.

4. Contactless Payments

As the name recommends, the contactless payments don’t include any contact between the device and the reader. It lets the users tap a card or wave their phones over the reader to make payments. Contactless payment is quicker in comparison to swiping or inserting cards.

A number of companies like Google, Apple, and Samsung have GooglePay, ApplePay, and SamsungPay, individually which utilize the contactless payment methods.

There’s a tremendous chance of them growing furthermore because of numerous different elements like contactless card accessibility, business adoption, and customer demand.

5. Omnichannel Payment Strategy

In the end, users care most about two things – saving money and time. And Mobile Payment Apps provide both of them.

Therefore, the shopping preferences of consumers have evolved rapidly after mobile payments came into the picture. In-application payments and one-click commerce have gained enormous popularity throughout the years. These days, numerous merchants have learned to manage multiple channels and formats. By using an omnichannel strategy for payments, the dealers can boost their in-store sales proficiency, consumer loyalty, post-sales services, and lessen the instances of frauds.

Wrapping Up

With that, we have seen it all – the scope of mobile payment apps and their future. From the entire data given above, it is evident that the future of mobile payment is brighter with continued growth expected in mobile-based transactions.

So, if you are a merchant, store owner, or an entrepreneur planning a venture in the mobile payment ecosystem – it is high time for you to take action.

Rate this article!

(1 ratings, average: 5.00 out of 5)

Join 60,000+ Subscribers

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Humane yet subtle, Naiya is a girl full of ideas about almost everything. After earning a bachelor’s degree in computer science and engineering, she decided to merge her technical knowledge with her passion for writing – to accomplish something interesting with the fusion. Her write-ups are usually based on technology, mobile apps, and mobile development platforms to help people utilize the mobile world in an efficient way. Besides writing, you can find her making dance videos on Bollywood songs in a corner.

Telemedicine 2.0 - A Comprehensive Guide On What Healthcare Providers Need To Know?

Discover how the latest advancements like Artificial Intelligence in telemedicine are reshaping patient care. This comprehensive resource offers insights into the key trends and innovations driving this shift, providing valuable knowledge for healthcare professionals looking to stay ahead.

Download Now!Subscribe to Unlock

Exclusive Business

Insights!

And we will send you a FREE eBook on Mastering Business Intelligence.